Caught ‘Tween the Devil and the Deep Blue Sea

“The devil and the deep blue sea…” The idiom harkens back to an era when wooden sailing vessels had a seam below the deck called the devil, which needed to be caulked regularly. Tasked with the job of sealing the devil, some unl... Jennifer MacMillan, EA

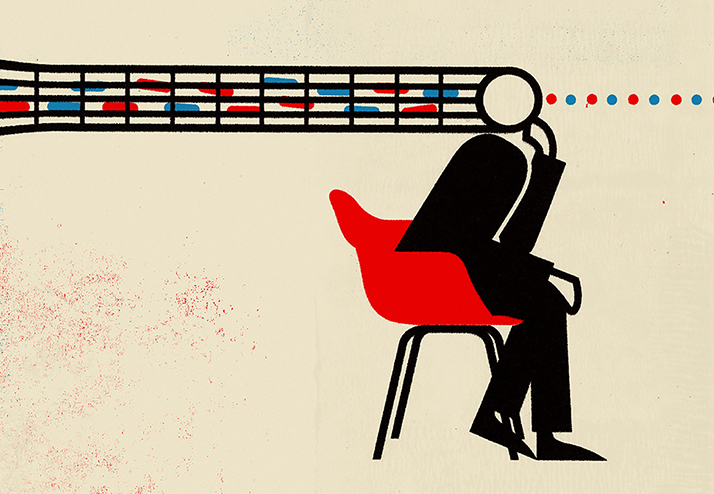

The Two Biggest Conflicts of Interest Overlooked by Tax Professionals

Election years always serve as a reminder to avoid conflicts of interest. They also serve as a reminder that it is often easier to identify someone else’s conflict of interest than one... Amber Gray-Fenner, EA, USTCP

Impact of Tax Reform on Choice of Entity

The tax reform legislation known as the Tax Cuts and Jobs Act that was passed by Congress and signed by President Trump on December 22, 2017, has significantly changed how many businesses and their tax advisors approach the choice of entity decision. When deciding on how to be cla... Timothy C. Smith, JD

Classification of Foreign Business Entities under U.S. Tax Law

An elementary question in business international taxation involves ascertaining the classification of foreign entities for U.S. tax purposes. This question emerges whenever a foreign business pursues U.S. economic activity or when a U.S. person establishes a business outside the U.S. While foreign entities enjoy definite classification under the laws of their respective countries of organization, their classification under U.S. tax law may be... Anthony (Tony) Malik, EA, MPAcc