The $80 Billion Question

On November 10, 2022, President Joe Biden nominated Danny Werfel to succeed Chuck Rettig as Commissioner of Internal Revenue.i Danny—or more formally, Daniel I.—Werfel testified on February 15, 2023, before the Senate Finance Committee, led by C... Robert Kerr, EA

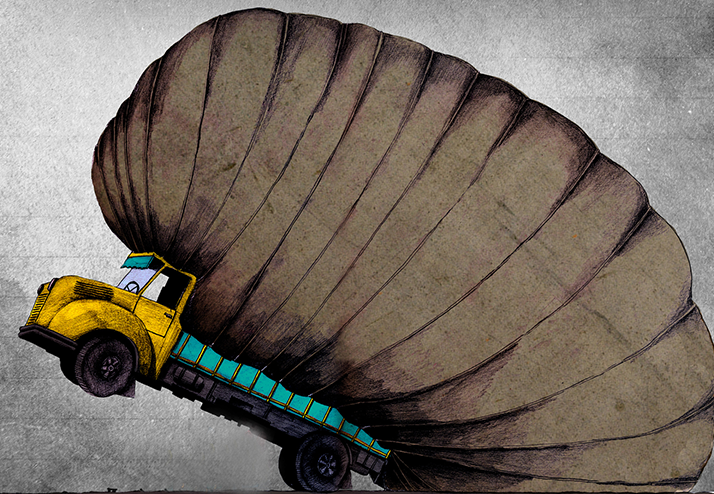

Success or Failure at the IRS: What Will Make the Difference?

For the first time, Congress has provided substantial long-term funding for the IRS. The unprecedented rebuilding program, which includes $80 billion of IRS funding over 10 years under the Inflation Reduction Act (IRA, P.L. 117-... Charles O. Rossotti

Creating a Taxpayer-Focused Internal Revenue Service

Enrolled agents and other tax professionals are not the only ones who get busy during tax season; Congress also takes a keen interest in tax law and tax administration during our busiest time of year. With that in mind, the NAEA Government Relations team got busy ad... Jennifer MacMillan, EA

Simple Solutions for a Better Tax System

Ask any experienced enrolled agent and he or she will tell you two things about the current tax system: IRS has fewer, more poorly trained personnel than at any time in the last 30 years; and at the same time, he or she can tell you that there is a proliferation of incompetent and (at ti... Jeffery S. Trinca, JD

Internal Revenue Service Reform

If at first you do not succeed, try and try again. We expect IRS reform may be one of the few tax legislative vehicles that moves through Congress this year. Bipartisan, bicameral efforts to pass a reform bill failed at the last minute before the end of the last Congress. But that failure does not seem to have we... Recommendations of the National Association of Enrolled Agents

Is IRS Ready to Implement Tax Reform?

While some of us are still recovering from our sunburns at the beach, many of us are looking at the shorter days and are beginning to worry if IRS has enough time to fully implement the Tax Cuts and Jobs Act (TCJA) in time for the 2019 filing season. Guidance, in the form of proposed regulations, notices, and forms and instructions, has certainly been helpful and much appreciated, but not having finalized these items is getting danger... Jeffery S. Trinca, JD

The IRS Revenue Officer: Friend or Foe?

It is likely you will encounter an IRS revenue officer who is difficult, unyielding, and possibly aggressive. You may perceive that the revenue officer's job is to make your and your client’s lives difficult. However, the truth is very different. Sure, a collection case making its way to a revenue officer is deemed serious by the IRS. After all, revenue officers are the IRS’s most experienced and sophisticated collection agents. Their foc... Howard S. Levy, JD

An Introduction to the Internal Revenue Manual

As a tax professional, what do you do when you encounter a client who has a problem or an issue which you have limited familiarity with or experience with? Do you prefer the client to another practitioner? Do you contact a colleague (or post a question in a forum) and hope that any advice that you receive will be sound? Or do you tell the client that you will do some additional research on the issue and get back to him? Your course of act... John G. (“Jack”) Wood, EA

Indirect Methods of Proving Income

Did you know the IRS requires its agents to perform a minimum income probe on every audit? And did you know that a minimum income probe can result in the IRS agent using indirect methods of proving income? If you have a client who is being audited—and even if you don’t—it is to your advantage to learn everything you can about indirect methods of proving income. Minimum income probes are discussed as part of the examination process governed... Jo-Ann Weiner, EA

Reading the Internal Revenue Code

Why would anyone subject themselves to reading the Internal Revenue Code? It’s not exactly a spellbinding novel, or even an interesting nonfiction work on your favorite topic, unless your favorite topic is tax law. When most people think of the Code, they think of it as being an impenetrable morass of legalese gobbledygook, more useful as a cure for insomnia than a practical resource for the tax professional. But being able to effecti... Carolyn Richardson, EA

2015 and 2016 Key Numbers

Single TAX RATES 2015 2016 10% bracket tops at 9,225 9,275 15% bracket tops atDavid Mellem, EA

The IRM: A Resource for the EA

It may not make the New York Times best seller list (and it certainly would not be light reading while waiting for a plane at the airport) but the Internal Revenue Manual (IRM) can be an extremely useful document for enrolled agents in their dealings with the Internal Revenue Service. The Freedom of Information Act at 5 USC 552(a)(2)(c) requires agencies to make staff instructions available to the public. Frank X. Degen, EA, USTCP