Will Your Client’s LLC Operating Agreement Make an Election Under Subchapter S Invalid?

Organization of a business enterprise as a limited liability company (LLC) has a number of advantages. In addition to ease of formation, state LLC acts dispense with many of the formalities required for corporations and wide latitude is given to... Patrick D. Dimmitt

SECURE Act Offers New Retirement Opportunities for Part-Time Workers

If your client sponsors or works with a 401(k) plan that currently excludes part-time employees from participating or accruing vesting service, read this article closely. The Setting Every Community Up for Retirement Enhancement (SECURE)... John R. Kirk, JD, and Alex S. Mattingly, JD

COVID-19 Presents Opportunities for Leave Sharing

In an attempt to find a silver-lining to the current health situation, this article examines how the current national emergency for COVID-19 presents an opportunity for employers to enhance their benefits for employees. While leave-sharing programs are common in the public s... John Kirk, JD, and Alex Mattingly, JD

As Streaming Subscriptions Surge, So Do Tax Complexities

Is your streaming company seeing a sudden surge in subscriptions? Many providers are. With consumers spending the bulk of their time at home these days, trials and signups are skyrocketing. While it can be easy for companies to get caught up in a whirlwind of widespre... Steve Lacoff

The Rules of Withholding, Redefined

The Tax Cuts and Jobs Act (TCJA)i is a far-reaching law, affecting almost every taxpayer. But, since most taxpayers are employees, one of its most profound impacts can be said to be on payroll administration. Due to structural changes in the Internal Revenue Code m... Alice Gilman

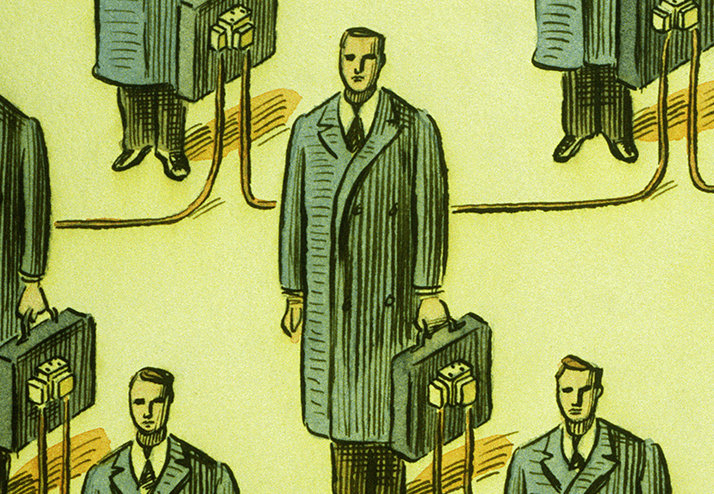

The Other Side of Employee Misclassification

Who wants to be an employee? Typically, employees are misclassified as independent contractors. And we know why — employers can save a bundle in Federal Insurance Contributions Act (FICA) and Federal Unemployment Tax Act (FUTA) taxes, as well as costly employee benefits, such as ... Alice Gilman, Esq.