The Creditability of Contemporaneously Paid Foreign Taxes

Taxpayers earning foreign source income can satisfy their foreign tax liabilities in one of several different ways depending on the character of the income earned, the taxpayer’s level of foreign activity... Anthony (“Tony”) Malick, EA

Tax Compliance for Refugees

“Give me your tired, your poor, your huddled masses yearning to breathe free…” – Emma Lazarus All... Mary Beth Lougen, EA, USTCP

Important Tax News You Can Use

Penalty Relief for 2019 and 2020 Tax Returns The Internal Revenue Service (IRS) is providing relief for taxpayers from certain failure-to-file penalties with respect to tax returns for the ... TheTaxBook

An Inquiry Into the Factors Aiding Clemency for Foreign Corporations Requesting Protective Tax Return Filing Deadline Waivers

Foreign corporations (FCs) often have varying degrees of U.S. business activities which in turn subject them to varying degrees of U.S. tax exposure. Anthony (“Tony”) Malik, EA

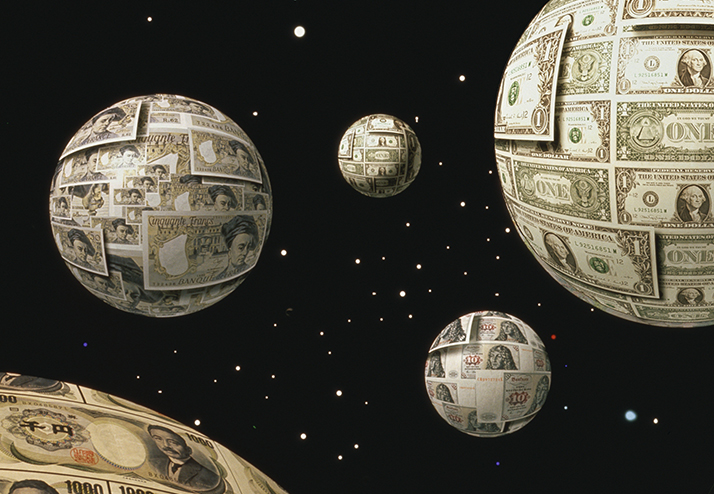

The Tax Cuts and Jobs Act Moves the U.S. Closer to a Territorial Tax System

The Tax Cuts and Jobs Act (TCJA) fundamentally changes the taxation of outbound activities of U.S. corporations and foreign corporations doing business in the U.S. and moves the U.S. international tax regime closer to a territorial system on par with other developed countrie... Sean Clancy, JD; Frank Emmons, JD; Shahzad Malik, JD

Undisclosed Foreign Accounts: Protecting the Executor

An executor administering an estate with undisclosed foreign accounts is exposed to substantial risks that may not be apparent. The following discussion is intended for executors and administrators who wish to understand and avoid those risks.1 A Typical Scenario A taxpayer dies. An executor is appointed and learns of foreign accounts: Tose foreign accounts hold investments. The ... Frank Agostino, Esq., Nicholas R. Karp, EA, USTCP

Taxation of Dividends From Foreign Corporations

U.S. persons frequently own legal entities abroad to pursue a variety of economic interests. Common U.S. ownership scenarios include expatriates forming foreign entities to locally operate businesses, U.S. residents forming foreign entities to capitalize on expansion opportunities, and entrepreneurial immigrants coming to the U.S. More often than not, these foreign entities default to corporate status à la the tax law’s default classification... Anthony (“Tony”) Malik, EA

Filing Requirements of Americans Abroad

Ownership of passive foreign investment company (PFIC) shares can easily be missed because their ownership is often hidden in security portfolio statements. A company is a PFIC by fulfilling one of two requirements; having at least 75 percent of its income be passive or having at least 50 percent of its assets be investments held for the production of passive income. Passive income includes, but is not limited to, interest, dividends, rents, ... Rainer Fiege-Kollmann, EA

Understanding the PFIC Rules and the Implications of Owning Foreign Mutual Funds

While many portions of the U.S. tax code possess confusing and sometimes harsh rulings, the tax rules for passive foreign investment companies (PFICs) are almost unmatched in their complexity and draconian features. Countless times, Americans overseas uncover a startling revelation that the small foreign investment they had made in a non-U.S. mutual fund is now subjecting them to all the significant filing requirements and tax obligat... Michael J. DeBlis III, Esq. and Randall Brody, EA

Classification of Foreign Business Entities under U.S. Tax Law

An elementary question in business international taxation involves ascertaining the classification of foreign entities for U.S. tax purposes. This question emerges whenever a foreign business pursues U.S. economic activity or when a U.S. person establishes a business outside the U.S. While foreign entities enjoy definite classification under the laws of their respective countries of organization, their classification under U.S. tax law may be... Anthony (Tony) Malik, EA, MPAcc

Streamlined Compliance Procedures for Non-disclosed Foreign Bank Accounts

With the global business environment changing, the world does not seem as vast. Advances in technology have increased awareness of different parts of the world and have made communication cheaper and more efficient. The U.S. citizen is now more mobile than ever before. Additionally, immigrants who may have thought the U.S. was an ultimate destination have begun to move back to their home countries because of equally attractive incomes and lif...