United States International Tax Treaties: A Guide for Early Career Tax Professionals

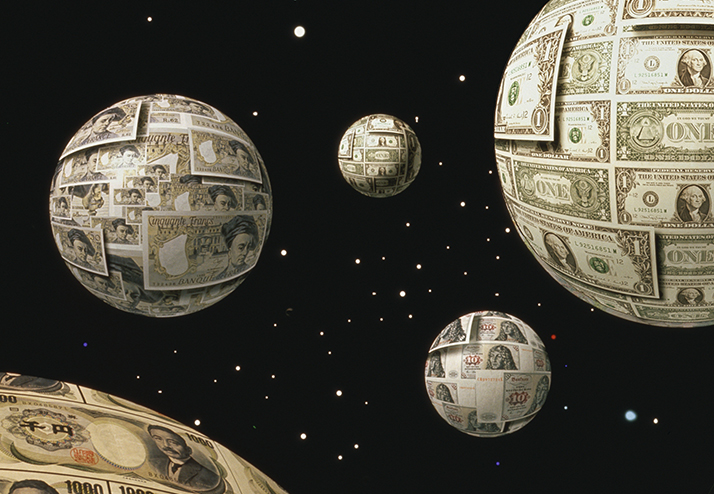

With increasing international trade and financial activities, United States taxpayers face the risk of double taxation, where two or more countries tax the same income. To mitigate this risk and foster international economic ... Sarah Eddie, EA

FBARS, Treaties, and Tax—Oh My!

As tax professionals, we often focus on familiar territory, honing in on our areas of expertise. However, clients may occasionally present us with unfamiliar, complex issues, particularly in the realm of international tax. Given the significant penalties for noncomplianc... Tynisa (Ty) Gaines, EA (She/Her)

Worldwide Tax Matters

I am intrigued by the intricate concept of worldwide income and its pivotal role in international taxation. The principle of taxing citizens on their global earnings underscores the belief that individuals should contribute to their home country's financial landscape, ir... Tynisa (Ty) Gaines, EA (She/Her)

The Creditability of Contemporaneously Paid Foreign Taxes

Taxpayers earning foreign source income can satisfy their foreign tax liabilities in one of several different ways depending on the character of the income earned, the taxpayer’s level of foreign activity... Anthony (“Tony”) Malick, EA

The “EA” as an International Credential?

The number of enrolled agents (EAs) in India has grown from 673 in 2017 to 2,262 in 2023. Enrolled agents in India now make up 3.1 percent of all enrolled agents. What’s driving this growth and how does it impact the EA profession, EA firms and employers, and the professional organi... Megan Killian

The Best (and Worst) Countries for Crypto Taxes in 2023

Cryptocurrency (crypto) has taken the world by storm, revolutionizing the way we perceive and use money. With this digital and financial revolution, the issue of crypto taxes has become a major concern for... Zac McClure and Tynisa (Ty) Gaines, EA (She/Her)

You Cannot Escape Cryptocurrency or International Tax Issues

You may wonder why this edition is not an ethics edition as is the EA Journal custom. Rumor has it that the Treasury Department plans to propose changes to Circular 230 this year. We have made an editorial decision this year to postpo... Thomas Gorczynski, EA, USTCP

Tax Policy 101

Those of you who have made the pilgrimage to the Internal Revenue Services’ (IRS) headquarters, which I have quasi-affectionately referred to as “the big house,” (or by its address, 1111 Constitution Avenue) may have noted the Oliver Wendall H... Robert Kerr, EA

Tax Reporting for Foreign Real Property Rentals

This article addresses the reporting of foreign real property rental activities conducted directly by individuals who are United States citizens or subject to United States taxation as resident aliens. The discussion focuses on foreign currency... Patrick D. Dimmitt, EA

Overview of the Foreign Earned Income Exclusion

There are two primary provisions that United States citizens can use to mitigate potential double taxation when working and living abroad: the foreign earned income exclusion and foreign tax credit. The foreign earned income exclusion al...

From Expat to Entrepreneur to EA

I did not know it at the time, but my enrolled agent (EA) journey began in 2002 when my wife, Carrie, and I moved from the United States to Barcelona to pursue our Master of Business Administration (MBA) degrees. When we graduated in 2004, we... David McKeegan, EA

Do No Harm

As someone who has been in the tax game for over 40 years and exclusively in the world of international tax for the last 18 years, my company has flourished and prospered on the mistakes of others. In 2013, when I... Mary Beth Lougen, EA, USTCP

Three Untapped Niches of Opportunity for Your Firm in 2021

Dentistry. Construction. Real estate. Working with clients in these industry verticals can provide your firm with incremental growth. While these niches are certainly solid areas to explore as you look toward increasing your firm’s profitab... Gaynor Meilke

International Representation: What You Should Know

Return preparation and representation of clients with offshore accounts and assets has become one of the hottest and fastest-growing areas in tax practice. It is a difficult and convoluted world of rules with high stakes that often lack definitive and clear guidance. Before taking on a taxpayer with foreign ties, be sure to read up on what needs to be filed, when it needs to be filed, and what defines “filed.” You will also want to know what ... Mary Beth Lougen, EA, USTCP