Keep an Eye on Special Payroll Tax Credits for the Rest of the Year

Congress enacted two laws — the Families First Coronavirus Response Acti (FFCRA) and the Coronavirus Aid, Relief, and Economic Security Actii (CARES Act) — in response to the coronavirus pandemic, which devastated the country late last winter. Both law... Alice Gilman, Esq.

A Primer on the New Excise Tax on Nonprofit Compensation

As a result of the Tax Cuts and Jobs Act, passed at the end of 2017, many nonprofits found themselves facing a significant tax on both the compensation of certain employees and any separation payments, often called “parachute payments,” paid to highly-compensated employees, u... Joan Vines, CPA, Norma Sharara

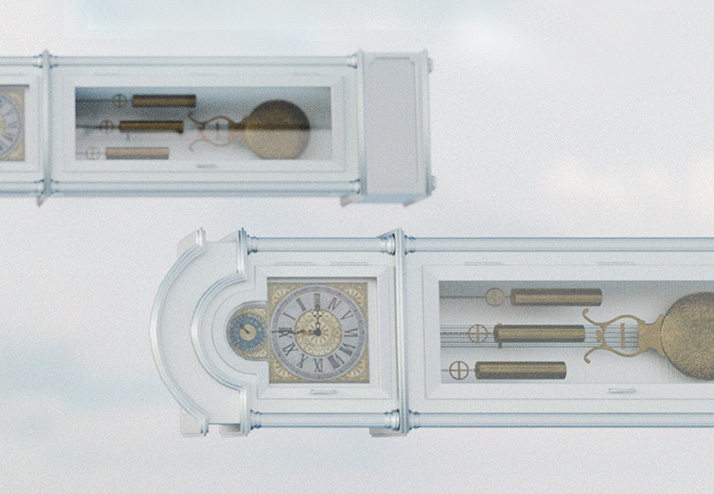

It’s Deja Vu All Over Again: New Tax Forms for 2019

Form 1040 changed significantly for the 2018 tax season. It is changing again for the 2019 tax year. It appears that the 2017 and 2018 forms had a baby — the 2019 form. In other words, the pendulum is swinging back a bit. Beth Logan, EA. 1040 and 1040-SR The cha... Beth Logan, EA

Why 2020 Will Probably Be the Start of a New Era for Payroll

Your payroll operations have been humming along for quite some time. Forever, maybe. All of that is about to change. The IRS is resolved to shake up all things payroll, beginning next year. The changes are wide-ranging and profound. Here is what we know now, based on draft forms ... Alice Gilman, Esq

Preparing For The New IRS Partnership Audit Rules

Partnerships and entities taxed as a partnership, such as certain limited liability companies (LLCs), have become a popular entity choice for doing business over the past 50 years. This tax structure offers business owners significant benefits, including taxation at only the partner level. Another benefit that often goes unnoticed is that very few partnerships are audited by the IRS. Moreover, when the IRS engages in a partnership audit, t... Travis Greaves, JD, Josh Wu, JD