I Am an Enrolled Agent

After college in 1989, I had to move back in with my parents because, let's face it, who is going to hire a 21 year-old with no experience being part of a team? And my degree was in communication, a double-whammy when it came to corporate governance in the 90s. I was feeling sorry for myself, ... Cheryl Williams, EA

Three Rules for Asking Great Tax Return Questions

Asking clients great questions is central to ruthlessly efficient workflow (REW) management. Great client questions can save hundreds of hours of time during tax season and prevent projects from falling behind schedule. Here is an example of questions done badly. ... Frank Stitely, CPA

The Road Less Traveled

My tax journey started in 2008. I was 29 years old, and living in Philadelphia, Pennsylvania, near my hometown of Cherry Hill, New Jersey, working in student services at the University of Pennsylvania. I was a student leader in college, both during undergraduate and graduate studies at the Un... Thomas A. Gorczynski, EA, USTCP

Planning for the Future

When I was young—18—and attending my local community and state college, I also had a part-time job typing financial records for Stanford University. These documents listed every location on the university’s campus with corresponding columns of numbers and totals. Accuracy was paramount. T... Jean Nelsen, EA

It’s Deja Vu All Over Again: New Tax Forms for 2019

Form 1040 changed significantly for the 2018 tax season. It is changing again for the 2019 tax year. It appears that the 2017 and 2018 forms had a baby — the 2019 form. In other words, the pendulum is swinging back a bit. Beth Logan, EA. 1040 and 1040-SR The cha... Beth Logan, EA

EA Exam Review Pass Faster with a Personalized Approach to Studying

Studying for the Special Enrollment Exam (SEE) can be an extensive process that, for many aspiring enrolled agents (EAs), can take hundreds of hours. Why should you take the exam? Because earning the enrolled agent credential grants you the privilege of representing ta... Lauren Nilssen

Citizen Advocacy – NAEA Style

For the eleventh year, NAEA members traveled to Washington, DC, to meet with their congressional representatives and senators to advocate on tax issues important to enrolled agents. The Congressional Fly-In, held this year on May 14, is a foundational event for NAEA’s advocacy program an... Rebecca Hawes

I Am Not a Therapist, but…

Taxes stress many people. As tax professionals, we end up asking questions which can raise a client’s anxiety level. “Do you have any interest income?” can lead to the answer “If my spouse would stop spending . . .” Looking for an exception to the Form 1099-R early wit... Beth Logan, EA

More than Initials Behind My Name

My enrolled agent (EA) journey began in 1995. At the nudging of my wife, I took a basic income tax course at a local box retailer. The topics, mainly the calculations, intrigued me, and by the end of the course, my confidence in tax preparation was high. I worked at the retailer f... James Roberson, Jr.

The Rise of the Tax Technologist

The demand for tax professionals who can handle technical and scientific details and can act as true partners and advisors to the business is stronger than ever in today’s complex enterprises. Audi. BMW. Daimler. We know what business these companies are in, right? But look... Kate Barton

Conflict of Interest

Clark J. Gebman and Rebecca Gebman v. Commissioner T.C. Memo. 2017-184) Even if we never practice in the U.S. Tax Court, as taxpayer representatives we must always be aware of our ethical duties. This is especially true when representing a husband and wife who previously filed a ... Sherrill Trovato, EA, USTCP

Ethical Due Diligence – Self Cancelling Terms

Due diligence. Two little words with oversized implications for tax professionals. In most cases, under the due diligence guidelines set forth in Circular 230, tax professionals can rely on the representations of their clients without having to verify the accuracy or veracity of those rep... Dave Du Val, EA

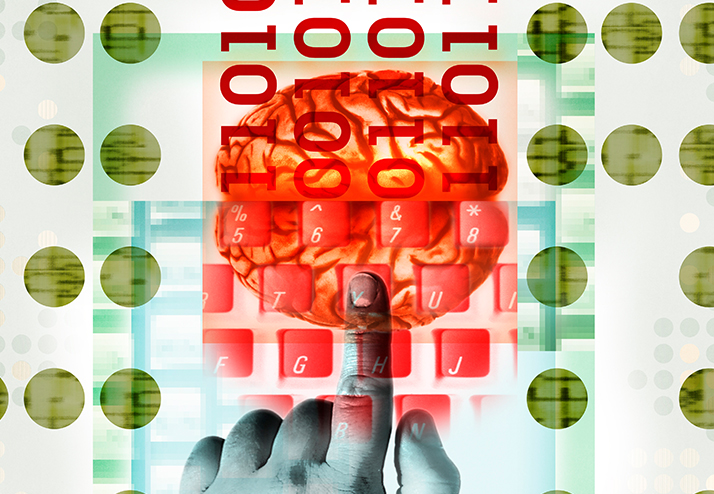

Tax Season Is Phishing Season

As the tax deadline approaches, work hours increase and more time is spent going through emails. This is the time when it is important to be extra vigilant when answering emails, and fulfilling client email requests. However, cybercriminals are a constant threat and once the new... Linda Hamilton, MFA

Increasing Business through Social Media

It seems that every time I talk to other tax professionals, they are worried about the changes in our industry and what is coming on the horizon. I know of four seasoned professionals who have retired primarily because they do not want to deal with the tax code changes i... Jennifer Brown, EA

Superchange Your Career in Tax: Become an EA

If you are considering a career in tax, there is no time like the present to obtain your enrolled agent (EA) license. EAs are America’s tax experts, and they are the only federally licensed tax preparers who also have unlimited rights to represent taxpayers before the IRS. Unlike some professional certifications, you can become an EA before you complete your degree, and there are many advantages in doing so. Start Now To become ...

Ethics Rules, Penalties, and the Tax Preparers Engagement Letter

Perhaps one of the most important, but also one of the most overlooked, parts of the 1040 U.S. Individual Income Tax Return is the section near the bottom of the second page that states: “Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct and accurately list all amounts and sources of income I received duri... Anthony Santullo, EA

The Adoption Tax Credit and Foster Care Adoptions

Do you have clients who are foster parents? Do you have clients who have adopted from the foster care system? If you have answered yes to either of these questions, you need to know about the Adoption Tax Credit. Many taxpayers who are adoptive parents have been told they do not qualify for the Adoption Tax Credit because they had no expenses. As tax professionals, we often hear our clients say, “My friend told me something different.” Wi... Becky Wilmoth, EA

Using Your Website and Social Media to Gain Clients

Websites and social media are great ways to attract younger clientele to your business. In our digitally interconnected age, it is imperative to have a website that is more than an online business card. Here are five tips for an effective website: 1. A modern website must be mobile-friendly. In a world where there are more mobile devices than there are people on Earth, it is essential that your website be mobile-friendly. What e... Jennifer Brown, EA

Walking the Tight Rope

NINE STEPS TO MAKE YOUR MARKETING EFFORTS FROM RUNNING AFOUL OF CIRCULAR 230 Marketing your business is a critical skill to develop for bringing in customers and preventing violations of the tricky regulations surrounding how we represent ourselves before the public. Frequently, there are posts on social media groups about how best to market our businesses, yet few responses ever mention the legalities. Most areas of Circular 230 ha... Crystal Stranger, EA