Employee Payroll Tax Deferral Guidance Creates Risk

The IRS issued guidance on August 28, 2020, (Notice 2020-65) implementing a White House directive to defer certain employee payroll taxes, but the guidance raises more questions than it answers and appears to expose employers to potentially significant repayment obligations and ... Dustin Stamper

Teleworking Employees, COVID-19, and the Resulting SALT Effects

The novel coronavirus (COVID-19) pandemic is changing the way we work. More specifically, it is changing where we work. At first blush, simply working from home might not raise any tax-related red flags. Why should it matter for a business whether its employees work f... Scott Smith, JD

As Streaming Subscriptions Surge, So Do Tax Complexities

Is your streaming company seeing a sudden surge in subscriptions? Many providers are. With consumers spending the bulk of their time at home these days, trials and signups are skyrocketing. While it can be easy for companies to get caught up in a whirlwind of widespre... Steve Lacoff

Revisiting Base Erosion and Anti-Abuse Tax Post-Pandemic: Final and Proposed Regulations are Worth a Second Look

In today’s economic environment, the base erosion and anti-abuse tax (BEAT) may apply to taxpayers who did not need to consider it as recently as three months ago. Considering recent economic developments and the Coronavirus Aid, Relief, and Economic Security (CA... Brian Abbey, JD

Your Questions Answered

1. Question: My clients, husband and wife, called to say that in 2019 they contracted with a local cooperative to facilitate the sale of grain from their farming operation. The business is operated as an LLC and taxed as a partnership with the clients as the sole partners. For tax...

Data and Network Security Risks Relating to the Coronavirus Outbreak and Response

In their response to the coronavirus outbreak, employees and other stakeholders will begin remote work and there is increased pressure on an organization’s cybersecurity risk management. A likely derivative effect of the outbreak, lower in priority but still significant, is increased pressure ... John Doernberg

What Does a Taxpayer Have to Do in Order to Show Abuse of Discretion in a Collection Due Process Case?

Valerie Bishop, Petitioner v. Commissioner of Internal Revenue, Respondent T.C. memo, 2020-36 | Filed March 17, 2020 In this collection due process (CDP) case, the taxpayer has the option of selecting a collection alternative such as an installment agreement or offe... Steven R. Diamond, CPA, USTCP

COVID-19 is Accelerating the Rise of the Digital Economy

If there were any lingering doubts about the necessity of digital transformation to business longevity, the coronavirus has silenced them. In a contactless world, the vast majority of interactions with customers and employees must take place virtually. With... Malcolm Cohron

Remote Work for Enrolled Agents: How to Increase Productivity and Protect Client Data

Making the change to work from a home office presents unique challenges for enrolled agents (EAs) and other tax professionals. However, adopting a few key best practices and utilizing the right tools can help you boost productivity, maintain work-life balance, and ensure ... David McKeegan, EA

Keep an Eye on Special Payroll Tax Credits for the Rest of the Year

Congress enacted two laws — the Families First Coronavirus Response Acti (FFCRA) and the Coronavirus Aid, Relief, and Economic Security Actii (CARES Act) — in response to the coronavirus pandemic, which devastated the country late last winter. Both law... Alice Gilman, Esq.

I Am an Enrolled Agent

After college in 1989, I had to move back in with my parents because, let's face it, who is going to hire a 21 year-old with no experience being part of a team? And my degree was in communication, a double-whammy when it came to corporate governance in the 90s. I was feeling sorry for myself, ... Cheryl Williams, EA

Tax Practice Management and Ethics

Managing a tax practice is tricky. I frequently meet clients who defend their tax choices and dicey positions because they feel it is correct. The disdain for tax agencies, particularly the IRS, becomes transparent in their conversations. To them, I am the governm... Thomas J. Williams, EA

Adapting Accounting Ethics to New Technology

The International Ethics Standards Board for Accountants (IESBA) recently restructured and revised its Code of Ethics for Professional Accountants. While the IESBA Code is not specifically geared toward management accounting and finance professionals, it d... Daniel Butcher

Three Rules for Asking Great Tax Return Questions

Asking clients great questions is central to ruthlessly efficient workflow (REW) management. Great client questions can save hundreds of hours of time during tax season and prevent projects from falling behind schedule. Here is an example of questions done badly. ... Frank Stitely, CPA

Common Ethical Issues in a Tax Practice

The nature of tax practice presents a number of unique ethical issues. Tax practice requires compliance with multiple ethical frameworks. This creates ambiguities and raises complex questions. Courts have even questioned whether certain regulatory... Ryan Dean

Tax Preparer Ethics in the Modern World

After the Civil War in 1884, Congress enacted a law known as the “Horse Act,” which allowed citizens to make claims against the Treasury Department for the value of horses confiscated for use by the troops. The Treasury soon discovered that people were making cl... Anita Robinson, EA

Your Questions Answered

1. Question: My client is a J-1 visa holder from France attending medical school in the United States to be a pediatrician. She first came to the U.S. in 2017 and began working as a medical researcher in the graduate medical program. In July 2019, my client began her medical residen... Brittany J. Benson, JD

Can a Taxpayer Prove Timely Filing of a Tax Court Petition If There Is No Postmark on the Envelope?

Michael J. Seely and Nancy P. Seely, Petitioners v. Commissioner of Internal Revenue, Respondent T.C. memo, 2020-6 | Filed January 13, 2020 If a taxpayer receives a statutory notice of deficiency (90-day letter) and wishes to petition the Tax Court, the taxpayer has 90 da... Steven R. Diamond, CPA

The Rules of Withholding, Redefined

The Tax Cuts and Jobs Act (TCJA)i is a far-reaching law, affecting almost every taxpayer. But, since most taxpayers are employees, one of its most profound impacts can be said to be on payroll administration. Due to structural changes in the Internal Revenue Code m... Alice Gilman

The Road Less Traveled

My tax journey started in 2008. I was 29 years old, and living in Philadelphia, Pennsylvania, near my hometown of Cherry Hill, New Jersey, working in student services at the University of Pennsylvania. I was a student leader in college, both during undergraduate and graduate studies at the Un... Thomas A. Gorczynski, EA, USTCP

The New Normal?

The outbreak of the coronavirus (COVID-19) has caused all of us to stop in our tracks, take stock of what’s important, and reassess the plans we set out for the year. This pandemic is changing our world. The novel coronavirus has disrupted modern working life for everyone. We’re all bei... Janelle Julien

An Inquiry Into the Factors Aiding Clemency for Foreign Corporations Requesting Protective Tax Return Filing Deadline Waivers

Foreign corporations (FCs) often have varying degrees of U.S. business activities which in turn subject them to varying degrees of U.S. tax exposure. Anthony (“Tony”) Malik, EA

In the Game of Fraud, How Accounting and Tax Leaders Take Charge

Concern for security in today’s public and private sector companies continues to be more and more critical in a world of ongoing digital transformation, and it involves preventing and fighting fraud. The Association of Certified Fraud Examiners reports that U.S. businesses will lose an... Laurent Charpentier

There’s No Crying in Tax Prep

Our readers fall into two buckets, those who read the March/April issue when it arrives and those who catch up later in the year. The magazine reflects this reality as well, as does this message. For those of you reading this when it falls on your doorstep (as the son of a postman, I have a rather romantic notion of mail delivery), the message is this: What gift are you going to give your future self? You are learning things during this fi... Robert A. Kerr

Your Questions Answered

1. QUESTION: My client is employed and has a side business that requires him to go to multiple locations. He regularly drives directly from delivering products to one of his business clients to his place of employment or from his employer to a meeting relating to his business. Ho... Marie Condley, EA

Planning for the Future

When I was young—18—and attending my local community and state college, I also had a part-time job typing financial records for Stanford University. These documents listed every location on the university’s campus with corresponding columns of numbers and totals. Accuracy was paramount. T... Jean Nelsen, EA

Reimbursing Employees’ Business Expenses after the TCJA

Reimbursing Employees’ Business Expenses after the TCJA The Internal Revenue Code does not require employers to reimburse employees’ out-of-pocket business expenses. Employees were not completely out-of-pocket if their employers chose not to reimburse those costs. The... Alice Gilman

What Qualifies as Real Estate Professional Hours for Passive Activity Purposes?

Ronnie Hairston and Gloria Cruz Hairston, Petitioners v. Commissioner of Internal Revenue, Respondent T.C. memo, 2019-104 | Filed August 20, 2019 Individual taxpayers can deduct passive activity losses for real estate rental activities, subject to limitations based on ad... Steven R. Diamond, CPA, USTCP

Tax Practice Management – Why Does It Matter?

Being a tax professional, you have certain due diligence requirements for the preparation of income tax returns. There are minimum standards that we all must follow. But I believe it is much more than a due diligence when preparing returns. Why, you might ask? I believe that our im... Dawn W. Brolin

Lessons Learned From the 2018 Tax Season

Now that the extended deadlines have passed for 2018 returns, we can take a moment to reflect on the lessons learned throughout a challenging year. Below we have put together five major takeaways we have come across to aid in planning for the 2019 tax year and beyond. To this end, please kee... Megan Bierwirth, CPA

A Primer on the New Excise Tax on Nonprofit Compensation

As a result of the Tax Cuts and Jobs Act, passed at the end of 2017, many nonprofits found themselves facing a significant tax on both the compensation of certain employees and any separation payments, often called “parachute payments,” paid to highly-compensated employees, u... Joan Vines, CPA, Norma Sharara

It’s Deja Vu All Over Again: New Tax Forms for 2019

Form 1040 changed significantly for the 2018 tax season. It is changing again for the 2019 tax year. It appears that the 2017 and 2018 forms had a baby — the 2019 form. In other words, the pendulum is swinging back a bit. Beth Logan, EA. 1040 and 1040-SR The cha... Beth Logan, EA

EA Exam Review Pass Faster with a Personalized Approach to Studying

Studying for the Special Enrollment Exam (SEE) can be an extensive process that, for many aspiring enrolled agents (EAs), can take hundreds of hours. Why should you take the exam? Because earning the enrolled agent credential grants you the privilege of representing ta... Lauren Nilssen

Demystifying §199A and Rental Activities

I read Gil Charney’s analysis of the application of §199A to a rental activity in the September/October 2019 edition of EA Journal (“Your Questions Answered,” pp. 12-13) and I do not agree with it. In that case, I believe the taxpayer clearly qualifies to take the §199A deduction on th... Thomas A. Gorczynski, EA, CTC, USTCP

Minimum Standards for Return Preparers

Ten years ago this December, IRS Commissioner Doug Shulman announced the creation of a program to regulate paid tax return preparers. After years of pushing and advocating, IRS had finally picked up the ball and scored a touchdown. Rebecca Hawes

Last Known Address as Viewed Through Duane Lee Chapman and Alice E. Smith, Deceased (T.C. Memo 2019-110, 8/29/19)

If as a tax professional you use your office address as a mailing address for your clients’ tax returns, or are ever tempted to do so, consider there may be unintended consequences. FACTS Mr. Chapman and his late wife operated their bail bonds operation on Queen Emma Street in Hono... Sherrill Trovato, EA, USTCP

Five Simple Tips Enrolled Agents can use to Find Lucrative Tax Resolution Clients

It is no secret that millions of taxpayers owe the IRS billions in taxes, and that, in fact, the number is only expected to grow in the coming years. It is also no secret that most of these overwhelmed taxpayers are buried under an avalanche of confusing forms, letters, and... Doresa Ibrahim

Your Questions Answered

1. QUESTION: Our client of several years called to tell us she has lived in Washington, DC, for nearly all of 2019. She took a staff position with a Representative from her home state. Does she have to file a DC tax return, or file only in her home state, or does she file a retur... Jackie Perlman, CPA

How AP Automation Puts the Smart in Smart Data Extraction

When it comes to invoice and payment processing (AP) automation, there is a lot of reference to optical character recognition (OCR). It is a buzzword that accounting professionals have likely heard about. What is it exactly? Optical character reco... Laurent Charpentier

Is Cryptocurrency a Major Opportunity for Enrolled Agents?

The short answer is yes. Cryptocurrency is a major opportunity for enrolled agents. However, seeing the opportunity and capitalizing on it are two different things. Blockchain > Cryptocurrency > Bitcoin You might already know this, but stil... Andy Frye, EA, Joshua Azran, CPA

Tax Change Transforms Charitable Giving Landscape

Donor-advised funds are growing in popularity as a way for individuals and corporations to give to charities. Broad-sweeping changes to the tax code at the end of 2017 sent nonprofits into a state of panic. The doubling of the standard deduct... Kim Moore

The 941 Resolution Clients Marketing Challenge

Ready to grow your tax firm? If you are looking to add the lucrative service of tax resolution to your practice, keep reading. The Habit of Daily Marketing To start, you are going to need to create a small piece of 941-specific messaging that answers the cla... Jassen Bowman, EA

Top 10 Changes in the Taxpayer First Act of 2019

On July 1, 2019, President Trump signed into law the Taxpayer First Act of 2019 (TFA), enacting changes to the IRS’s organizational structure, customer service, enforcement procedures, management of information technology, and use of electronic systems, with a focus on improving its int... Sidney Kess, JD, LLM, CPA, Steven I. Hurok, JD, CPA

When Is a State Refund Taxable

The TCJA Raises Some Questions. As anyone not living under a rock these last 18 months knows, the Tax Cuts and Jobs Act (TCJA) imposed a $10,000 ($5,000 married filing separately) cap on deductions of state and local taxes (SALT)—including income, real estate, property, and s... Gil Charney, CPA/PFS, CFP, CGMA, CMA, MBA

Why 2020 Will Probably Be the Start of a New Era for Payroll

Your payroll operations have been humming along for quite some time. Forever, maybe. All of that is about to change. The IRS is resolved to shake up all things payroll, beginning next year. The changes are wide-ranging and profound. Here is what we know now, based on draft forms ... Alice Gilman, Esq

Your Questions Answered

1. QUESTION: My client sustained considerable damage to his home in Dayton, Ohio, following the storms, flooding, etc., in his area this past June. It may take him some time to get appraisals, resolve his insurance claim, etc. At this point, he does not know the size of the loss ... Jackie Perlman

Citizen Advocacy – NAEA Style

For the eleventh year, NAEA members traveled to Washington, DC, to meet with their congressional representatives and senators to advocate on tax issues important to enrolled agents. The Congressional Fly-In, held this year on May 14, is a foundational event for NAEA’s advocacy program an... Rebecca Hawes

How to Manage Taxpayers Complaints

What is the form for reporting customer service-related complaints regarding the Internal Revenue Service? The answer will appear at the end of this article (remember that everyone’s tax problem is an emergency to him!). The Taxpayer Advocacy Panel Within the Taxpayer Ad... Cheryl Williams, EA

I Am Not a Therapist, but…

Taxes stress many people. As tax professionals, we end up asking questions which can raise a client’s anxiety level. “Do you have any interest income?” can lead to the answer “If my spouse would stop spending . . .” Looking for an exception to the Form 1099-R early wit... Beth Logan, EA

Impact of the Wayfair Supreme Court Decision on Nonprofits

Sales tax is imposed upon retail sales of tangible personal property and taxable services in 45 states and the District of Columbia. Each state determines the circumstances under which a sales tax is imposed on the purchaser. Purchases by nonprofit organizations are exempt in most... Katherine Gauntt

More than Initials Behind My Name

My enrolled agent (EA) journey began in 1995. At the nudging of my wife, I took a basic income tax course at a local box retailer. The topics, mainly the calculations, intrigued me, and by the end of the course, my confidence in tax preparation was high. I worked at the retailer f... James Roberson, Jr.

Successful Journey to Tax Court Practice

“This was the most physically and intellectually demanding exam I have ever taken,” reports Amber Gray-Fenner, EA, USTCP, who passed the November 8, 2018, Tax Court exam on her first attempt. She took it because it seemed “like all the people I admired on the Facebo... Sherrill Trovato, EA, USTCP

Tax code changes put nonprofits in a bind

In 2016, a new record was surpassed in private giving to charities. Individuals, estates, foundations, and corporations were estimated to have contributed a record $390 billion to U.S. nonprofits, according to a report published in 2017 by Giving USA Foundation, an initiativ... Kim Moore

Reasonable Reliance on a Tax Pro to Avoid Accuracy Related Penalties as Viewed Through Carlos Langston and Pamela Langston v. Commissioner

Mr. Langston has a bachelor’s degree in business administration and a master’s degree in petroleum engineering. Since graduating in 1990, he has been self-employed in the oil and gas industry. Mrs. Langston holds a bachelor’s degree in accounting and a Juris Doctor degree. Whil... Sherrill Trovato, EA, USTCP

Tax Reform Means Strategic Opportunities For Nonprofits

“The GOP tax reform will devastate charitable giving.”i “Nonprofits are the unintended victims of the new tax bill.”ii “Tax reform could cost charities $13 billion a year.”iii While ... Ellie Burke

The Dollars and “Sense” of Accounts Payable Automation: How Cost Savings Translate Directly to the Bottom Line

There is no doubt that finance and accounting leaders are realizing the value of automating their invoice and payment (AP) processing workflows. In fact, an impressive 84 percent of accounts payable practitioners are optimistic about the progress their department will make ove... Laurent Charpentier

The Other Side of Employee Misclassification

Who wants to be an employee? Typically, employees are misclassified as independent contractors. And we know why — employers can save a bundle in Federal Insurance Contributions Act (FICA) and Federal Unemployment Tax Act (FUTA) taxes, as well as costly employee benefits, such as ... Alice Gilman, Esq.

The Price of Doing Good

It may seem early to think about #GivingTuesday, but the giving season will be here before you know it. I have a few charities I contribute to every year and also to those that spring into action whenever disaster strikes. Several factors motivate people to make charitable donations, i... Janelle Julien

Your Questions Answered

1. Enrolling in Medicare and Retroactive Impact on Health Savings Accounts I have a client, age 68, who retired and enrolled in regular Medicare in October. She was covered under her employer’s high deductible health plan (HDHP) from January through September, and continued to co... Gil Charney, CPA/PFS, CFP, CGMA, CMA, MBA

Blockchain Technology And What it Means For Tax Professionals

The business world has been slow to warm up to virtual currency. Bitcoins are accepted by Overstock.com , but not by Amazon.com. Signs reading “Bitcoin accepted here” are scattered throughout Chicago, New York, and San Francisco, but are not commonplace nationwide. In many ... Peter Horadan

Blockchain Technology Explained

Blockchain tech plays an important role in cryptocurrency mining Blockchain technology allows for fast, secure, and transparent peer-to-peer transfer of digital goods that include money and intellectual property. In cryptocoin miningiScott Orgera

Crypto Tax Tech Tools To the Rescue?

What is a crypto tax tool? For the purpose of this article, a cryptocurrency tax tool is defined as a software program designed to assist taxpayers and tax professionals with the often onerous job of calculating gains, losses, and other tax implications associated... Andy Frye, EA; Joshua Azran, CPA

Cryptocurrency Taxation Trends: Spring Always Follows Winter

Writers who cover the cryptocurrency space are nothing if not prolific. Well into 2018, legions of them trumpeted the glow of the crypto messiah. Those same writers now have the grimmer task of writing about what is commonly called the “crypto winter.” ... Michael Minihan

RPA Enables Tax Pros to Focus on Planning

It is not hard to recognize the value of robotic process automation (RPA). Robotic process automation relieves staff of repetitive tasks, increases the usability of data, virtually eliminates errors, and boosts efficiencies. Tax professionals would welcome any of these results, but is ther... McClur

Simple Solutions for a Better Tax System

Ask any experienced enrolled agent and he or she will tell you two things about the current tax system: IRS has fewer, more poorly trained personnel than at any time in the last 30 years; and at the same time, he or she can tell you that there is a proliferation of incompetent and (at ti... Jeffery S. Trinca, JD

Peace of Mind: Technology Security and Your Enrolled Agent Community

As an enrolled agent of some years, I began practicing when all you needed was your certification, a calculator, green columnar paper, blank tax forms – and clients. But the practice of tax professionals has altered so dramatically that we simply cannot ... Vicki Ferrantello, EA, NTPI Fellow®

Tax Technology APIs

Tax technology is rapidly changing to keep pace with the recent year’s tax law changes, be it federal income tax, state income and franchise, or state sales and use taxes. One configurable and customizable solution to tax technology is application programming interfaces (APIs). What... Alyssa Marchand, MST

Tech Speak

Let me introduce myself: I’m NAEA’s new(ish) managing editor. You’ve noticed by now that EA Journal looks different these days. I know how protective readers can feel about the magazines they love, and I respect that. A serious, loyal readership may be our most valua... Janelle Julien

The Problems with Form W-2c

Employees must receive Forms W-2, Wage and Tax Statement, by January 31. More than likely, they glace at their forms and then drop everything off with their tax professional. It is an annual ritual everyone understands. But that is assuming that all the information reported on t... Alice Gilman, Esq.

The Rise of the Tax Technologist

The demand for tax professionals who can handle technical and scientific details and can act as true partners and advisors to the business is stronger than ever in today’s complex enterprises. Audi. BMW. Daimler. We know what business these companies are in, right? But look... Kate Barton

Your Questions Answered

1. When Can You Deduct the Interest on a Home Equity Loan? My clients called to say they are considering buying a small lake home that they will use for long weekends, vacations, etc., and possibly for retirement in the future. To buy it, they are thinking of taking out a home equity loan on their primary residence. They did not give any particular reason other than to say “that will just be easier for us than getting a mortgage on ... Jackie Perlman, CPA

Does Net Rental Income Quality For the Section 199A Deduction

Does Net Rental Income Quality For The SECTION 199A Deduction? By David M. Fogel, EA, CPA, USTCP One of the changes made by the Tax Cuts and Jobs Act of 2017 (P.L. 115-97) was to introduce a new 20 percent deduction for qualified business income. The deduction is intended to benefit taxpayers who have net business income. One of the questions being debated in the tax preparer community... David M. Fogel, EA, CPA, USTCP

Reconstructing Vehicle Mileage Logs

Reconstructing Vehicle Mileage LOGS By Bill Nemeth, EA Most examinations of personal tax returns involving Schedule C self-employment request information on car and truck expenses. IRS recommends contemporaneous mileage logs per IRC §1.274-5T(c)(1), but does not require them. The code makes the point that the records should be created in “close” proximity to the time of the activity. Adequat... Bill Nemeth, EA, NTPI

Conflict of Interest

Clark J. Gebman and Rebecca Gebman v. Commissioner T.C. Memo. 2017-184) Even if we never practice in the U.S. Tax Court, as taxpayer representatives we must always be aware of our ethical duties. This is especially true when representing a husband and wife who previously filed a ... Sherrill Trovato, EA, USTCP

Ethical Due Diligence – Self Cancelling Terms

Due diligence. Two little words with oversized implications for tax professionals. In most cases, under the due diligence guidelines set forth in Circular 230, tax professionals can rely on the representations of their clients without having to verify the accuracy or veracity of those rep... Dave Du Val, EA

Cryptocurrency Tax Preparation: Ethics Nightmare

"Who makes more money: the general practitioner doctor or the specialist spine surgeon?" Consultants love to ask that question, as part of recommending that tax professionals specialize our services. And, yes, we must admit: the question is a valid one. Specialists often do enjoy str... Andy Frye, EA; Joshua Azran, CPA

NAEA’s Cyber-insurance Program

This article introduces the coverage within the cyber-liability policy offered to the NAEA membership. The policy is supported by Lloyds of London utilizing a London managing general underwriter (CFC), and a U.S. domestic surplus lines broker (Evolve) and offered through The Arrow Group locate... The Arrow Group

OPR Radar (for how long?)

You have been a licensed tax professional representing your clients before IRS for many years. On a current controversial complex case, unknown to you, the IRS agent you have been working with files a “Report of Suspected Practitioner Misconduct” with the Office of Professional Responsibilit... Ruth Ann Michnay, EA, CPA, USTCP

Social Media and Professional Etiquette

Although social media sites started over twenty years ago, their role as a communications tool is continually evolving. Many enrolled agents look to social media sites for an opportunity to network with colleagues, seek answers to perplexing issues, and even commiserate ... Trish Evenstad, EA; Melissa Longmuir, EA,

Value Versus Cost: A Payroll Primer

Tax and accounting professionals are certainly familiar with the concepts of value and fair market value. For example, the entire cost of employer-provided health insurance is deductible by the employer and the value is equally excluded from employees’ income. Likewise, ... Alice Gilman, Esq.

Your Questions Answered

1. Qualified Business Income and the Statutory Employee Question: I have a few clients whose Form W-2, box 13 shows them as statutory employees. Assuming they are properly classified, would they qualify for the qualified business income (QBI) deduction in §199A? An... Gil Charney, CPA

Ethical Behavior and Tax Prep

Last August, Paul M. was convicted on five charges of tax fraud, and one charge of hiding foreign bank accounts. While these are criminal offenses, let’s look at the ethical behavior of his tax preparer. Cindy L., an employee of KWC, prepared Paul M.’s 2014 and 2015 ... Lonnie Gary, EA, USTCP

A New Opportunity for Nonresident Aliens: Ownership in an S Corporation Introduction

Changes to U.S. tax law brought about by the 2017 Tax Cuts and Job Acti (TCJA) have affected many longstanding tax planning tools. One favorable change amends the rules regarding the persons who can own shares of an S corporation. Historically, the S corporation election was ... Rusudan Shervashidze, JD; Stanley C. Ruchelman, JD

Books to Tax in a Snap

When clients hands over a QuickBooks (QB) file at income tax time, the expectation is you have what you need and tax preparation will be a breeze. Depending on the client, you are either elated or you want to cringe; there is not much in between. It is important for tax preparers to feel ... Geri Bowman, EA, CPA, USTCP

Does IRS Refusal of a Taxpayer’s Proposed Offer for an Installment Agreement Constitute an Abuse of Discretion?

Kenneth Pitner, Petitioner v. Commissioner of Internal Revenue, Respondent T.C. Memo 2016-237 | Filed December 29, 2016 The IRS will pursue collection activities if a taxpayer has an unresolved outstanding debt with them. If the taxpayer disagrees with the amount of tax the ... Steven R. Diamond, CPA, USTCP

Impact of Tax Reform on Choice of Entity

The tax reform legislation known as the Tax Cuts and Jobs Act that was passed by Congress and signed by President Trump on December 22, 2017, has significantly changed how many businesses and their tax advisors approach the choice of entity decision. When deciding on how to be cla... Timothy C. Smith, JD

Mitigating Penalties for Filing Incorrect Forms W-2

Forms W-2 were filed with the Social Security Administration (SSA) by January 31, 2019, but that is the end of the story only if all those Forms W-2 are correct. While 100 percent accuracy is always the goal, it is rarely achieved. So, the second part of the year-end pro... Alice Gilman, Esq

So You Want to Buy a Tax Practice

Many tax professionals may start their career working in a tax office gaining experience while others start out completely on their own. Either way, you may eventually ask yourself the question, “How do I grow my practice?” There is definitely no right, wrong, or easy answer... Twila D. Midwood, EA, NTPI Fellow®

Tax Season Is Phishing Season

As the tax deadline approaches, work hours increase and more time is spent going through emails. This is the time when it is important to be extra vigilant when answering emails, and fulfilling client email requests. However, cybercriminals are a constant threat and once the new... Linda Hamilton, MFA

The enrolled agent’s life is one to live! Pick a life and jump in.

My enrolled agent career started in 1987 when I received my master’s degree in accounting and finance from Regis University. Working at my own practice, JCP Financial, Inc., has been a wonderful ride of helping people with the many questions that arise on how to file their ... Carlton P. Johnson, Jr., EA, MBA

Sales Tax Nexus: South Dakota v. Wayfair, Inc. – The Facts

On June 21, 2018, the Supreme Court of the United States ruled on South Dakota v. Wayfair, Inc. The Supreme Court was asked to examine the physical presence precedents it set in two prior cases: Quill Corp. v. North Dakota (U.S. Supreme Court, No. 91- ... Alyssa Marchand, MST

The Gig Economy

The gig economy is a growing income sector in the world and a growing niche for tax professionals to harvest. Before jumping into this market, it is necessary to know some things about this area of practice. Let’s start with the definition of a gig, per Merriam-Webster: “a job usually for ... Kathryn M. Morgan, EA

Typical Payroll Tax Issues Amid Changes in the TCJA

After processing 2018 year-end payroll, employers may see the need to reevaluate processes, procedures, and tax configurations in the payroll system to ensure compliance amid the substantial changes created by the 2017 tax reform known as the Tax Cuts and Jobs Act... Joan Vines

The Tax Cuts and Jobs Act Moves the U.S. Closer to a Territorial Tax System

The Tax Cuts and Jobs Act (TCJA) fundamentally changes the taxation of outbound activities of U.S. corporations and foreign corporations doing business in the U.S. and moves the U.S. international tax regime closer to a territorial system on par with other developed countrie... Sean Clancy, JD; Frank Emmons, JD; Shahzad Malik, JD

Sales Tax Nexus: The Unintended Consequences of South Dakota v. Wayfair, Inc.

On July 24, 2017, the U.S. House Judiciary Committee held a hearing to discuss the implications of the South Dakota v. Wayfair, Inc. Supreme Court ruling. The Supreme Court overruled the physical presence nexus in this case, in favor of allowing the states to impose economic nexus standards... Alyssa Marchand, MST

Your Questions Answered

Question: Several of our clients are Canadian or Mexican citizens who live and work in the U.S. and file U.S. resident alien tax returns. Their families live in Canada or Mexico. In the past, they were able to claim exemptions for their dependents. What tax benefits will these clients qualify for, now tha... Jackie Perlman, CPA

Employees and the Self-employed: A Comparison under the Tax Cuts and Jobs Act

The 2017 Tax Cuts and Jobs Act (TCJA), signed into law on December 22, 2017, is favorable to businesses of all types – corporations, partnerships, and sole proprietorships. The TCJA reduced C corporation taxes to a flat rate of 21 percent, down from a gradua... Gil Charney, CPA/PFS, CFP, CGMA, CMA, MBA

Home Mortgage Interest & TCJA

I have been preparing income tax returns for more than forty years. During that time, there have been many changes as to how nonbusiness interest expense has been treated on Schedule A of a client’s personal income tax returns, Form 1040. In my first couple tax ... C. Dale Boushley, EA, CFP

For Purposes of the Passive Activity Rules under IRC §469, How Can a Real Estate Professional Credibly Establish Hours of Participation so as to Avoid Limitations on the Amount of Losses Claimed?

Roberta Birdsong and William H. Birdsong, Petitioner v. Commissioner of Internal Revenue, Respondent T.C. Memo 2018-148 | Filed September 10, 2018 A passive activity is one that involves the conduct of any trade or business in which the taxpayer does not mater... Steven R. Diamond, CPA

Increasing Business through Social Media

It seems that every time I talk to other tax professionals, they are worried about the changes in our industry and what is coming on the horizon. I know of four seasoned professionals who have retired primarily because they do not want to deal with the tax code changes i... Jennifer Brown, EA

Post-TCJA Qualified Personal Residence Trust Planning

The sweeping changes of the Tax Cuts and Jobs Act (TCJA) have prompted a reconsideration of many financial plans. The realm of estate planning will be especially affected by the TCJA’s doubling of the federal estate tax exemption. The author presents a hyp... Martin Shenkman, CPA/PFS, JD, AEP

Rethinking Our Use of the DMSH

When the IRS added the de minimis safe harbor (DMSH) election to the repair and capitalization regulations, practitioners rejoiced. Use of this election allows our clients to immediately expense small asset purchases provided that the asset cost is $2,500 or... Thomas A. Gorczynski, EA, CTC, USTCP

The QBI Effect – §199A

This topic can easily occupy several hours. So, what is all the hype about? Qualified business income (QBI) qualifies a small business to deduct up to 20 percent off its net income. This is income that normally gets reported on Form 1040. This includes sole proprietors, andlords, farmers, p... Ben A. Tallman, EA, USTCP

What Are They Doing with Tax Forms

Please remember that this article was written in late September based on the draft forms available at that time. Some changes may have occurred between that date and the publishing of this article. Line 7 Wages. Line 21 — Other income. Lines 37 and 38 – adjusted gross income (AG... Beth Logan, EA

Year-end Responsibilities for Payroll

The taxes that have been withheld from employees’ pay during the year, and the employer’s matching Federal Insurance Contributions Act (FICA) contribution, have been reported to the IRS quarterly on Form 941. Everything, except the employer’s matching FICA contribution, mu... Alice Gilman, Esq.

Your Questions Answered

1. Reporting IRA Recharacterizations Question: We know that under the Tax Cuts and Jobs Act (TCJA), IRA recharacterizations of Roth conversions are no longer permitted for any conversion that was done after December 31, 2017. However, how would we know from a Form 1099-R ... Gil Charney, CPA/PFS, CFP, CGMA, CMA, MBA

Fraudulent Tax Returns, Penalties, and Amended Tax Returns

Generally, a taxpayer may correct an error in a tax return without incurring interest or penalties by filing an amended return and paying any additional tax due on or before the due date (last day prescribed for filing). An amended return filed after the due date may be accepted, rejected, or ignored by the IRS in its sole discretion. It has been held that where the taxpayer files a false or fraudulent tax return but later... Steven R. Diamond, CPA, USTCP

International Representation: What You Should Know

Return preparation and representation of clients with offshore accounts and assets has become one of the hottest and fastest-growing areas in tax practice. It is a difficult and convoluted world of rules with high stakes that often lack definitive and clear guidance. Before taking on a taxpayer with foreign ties, be sure to read up on what needs to be filed, when it needs to be filed, and what defines “filed.” You will also want to know what ... Mary Beth Lougen, EA, USTCP

2018 Tax Law Changes

This year, we get to deal with many tax changes. Members of Congress, as well as presidential candidates, stated that one of their goals was to simplify the tax code (U.S. Code title 26). And simplification has occurred to some extent with Public Law 115-97, also known as the Tax Cuts and Jobs Act of 2017 (TCJA). Congress made some issues simpler while creating at least one new issue that has confused many. Many popular de... David Mellem, EA

I Spy Tax Fraud! Do You?

The word “fraud” conjures up many images, none of which are positive. As Circular 230 tax professionals, we never knowingly jeopardize our credentials while serving clients. Ever cautious, we could, nevertheless, find ourselves representing a client who has engaged in fraudulent activity. Can you recognize the signs of tax fraud? How do you handle a client’s matter with potential or actual fraudulent transactions? According to the Interna... Alan L. Pinck, EA, Ann E. Kummer, EA, CPA

Is an Analysis of the Thought Process of the Approving Supervisor Required in a Case Involving a Trust Fund Recovery Penalty?

Under IRC §§6320 and 6330, taxpayers have the right to a collection due process (CDP) hearing, which provides them with an independent review by the IRS Office of Appeals of the decision to file a Notice of Federal Tax Lien or the IRS’s proposal to undertake a levy action. At the hearing, the taxpayer has a statutory right to raise any relevant issues related to the unpaid tax, lien, or proposed levy, including the appropriateness of ... Steven R. Diamond, CPA

Is IRS Ready to Implement Tax Reform?

While some of us are still recovering from our sunburns at the beach, many of us are looking at the shorter days and are beginning to worry if IRS has enough time to fully implement the Tax Cuts and Jobs Act (TCJA) in time for the 2019 filing season. Guidance, in the form of proposed regulations, notices, and forms and instructions, has certainly been helpful and much appreciated, but not having finalized these items is getting danger... Jeffery S. Trinca, JD

The IRS Revenue Officer: Friend or Foe?

It is likely you will encounter an IRS revenue officer who is difficult, unyielding, and possibly aggressive. You may perceive that the revenue officer's job is to make your and your client’s lives difficult. However, the truth is very different. Sure, a collection case making its way to a revenue officer is deemed serious by the IRS. After all, revenue officers are the IRS’s most experienced and sophisticated collection agents. Their foc... Howard S. Levy, JD

Overview of Practice Before the U.S. Tax Court

This article will focus on income tax deficiency and collection due process (CDP) jurisdiction, but the Tax Court also has jurisdiction over IRS’s denial or refusal to act on abatement of interest under IRC §6404 and innocent spouse cases under §6015; cases related to employment status; and denial of whistleblower claims, among others. The Tax Court was established to handle tax deficiency cases that require a timely filed notice of defic... Sherrill Trovato, EA, USTCP

Does Good Faith Reliance on a Tax Preparer Allow a Taxpayer to Avoid a Substantial Understatement of Tax Penalty?

Does Good Faith Reliance on a Tax Preparer Allow a Taxpayer to Avoid a Substantial Understatement of Tax Penalty? Gregory S. Larson, Petitioner v. Commissioner of Internal Revenue, Respondent T.C. No. 2018-30, Filed March 19, 2018 By Steven R. Diamond, CPA IRC §§6662(a) and (b)(1) and (2) impose a 20 percent accuracyrelated penalty on an underpayment of federal income tax that is... Steven R. Diamond, CPA

Action Required, Addressing the Complexity of Tax Practice Rules

Historically, Circular 230 has embodied the regulation of tax practice before the IRS, including the ethical standards that tax practitioners must follow. Originally, 31 USC Sec. 330, which originated in the Horse Act of 1884, granted the secretary of the Treasury the authority to regulate agents representing claimants before the Treasury Department. Treasury used circulars to provide guidance to these agents. In 1921, these circulars were co... Marshall J. Heap, EA

Become Americas Advanced Tax Expert

BECOME AMERICA’S ADVANCED TAX EXPERT BY Mary Sunderland, EA, USTCP & Bill Nemeth, EA Do you want to stand out as a tax practitioner? Are you confident that you offer the latest and best tax advice to your clients? Do you want to grow your business by taking on more complicated tax returns and representation clients? Do you want to know the tax experts in these areas? ... Mary Sunderland, EA, USTCP

Governors From 22 States Issue “Enrolled Agent Week” Proclamations

GOVERNERS OF 22 STATES ISSUES ENROLLED AGENT WEEK PROCLAMATIONS By John Michaels Every year, representatives from NAEA state societies across America ask the governor from their respective state to help kick off filing season by issuing a proclamation declaring the first week in February “Enrolled Agent Week.” We ask for these proclamations in an effort to help educate the public about th... John Michaels

Tax Reform Implementation Recommendations to IRS

Tax Reform Implementation Recommendations to IRS By Justin Edwards After nearly a year of continued efforts, and at the urging of the White House, House and Senate Republicans shepherded the Tax Cuts and Jobs Act of 2017 (TCJA) through both chambers, and the president signed the measure into law days before the Christmas holiday. Obviously, the Internal Revenue Code has... Justin Edwards

When Does the Six-Year Statute of Limitations Apply to the Reporting of Specified Foreign Financial Assets?

When Does the Six-Year Statute of Limitations Apply to the Reporting of Specified Foreign Financial Assets? Mehrdad Rafizadeh, Petitioner v. Commissioner of Internal Revenue, Respondent 150 T.C. No. 1 Filed October 2, 2017 By Steven R. Diamond, CPA The Foreign Account Tax Compliance Act (FATCA) provides that any individual who holds an interest in a specified foreign financial as... Steven R. Diamond, CPA

How I Got Into Tax and Why I Love It

When I was in high school, my 11th-grade English teacher noticed that I wrote really well and loved to read, but I was getting a D in her class. She determined that I was bored and wasn’t being challenged. So, I was moved to Honors English. My first day in Honors English we were given the assignment to write a short story. At the time, I was reading a lot of Clive Barker novels, and I wrote a 25-page story called “Meat Loc... Craig W. Smalley, EA

Undisclosed Foreign Accounts: Protecting the Executor

An executor administering an estate with undisclosed foreign accounts is exposed to substantial risks that may not be apparent. The following discussion is intended for executors and administrators who wish to understand and avoid those risks.1 A Typical Scenario A taxpayer dies. An executor is appointed and learns of foreign accounts: Tose foreign accounts hold investments. The ... Frank Agostino, Esq., Nicholas R. Karp, EA, USTCP

Does a Tax Treaty Govern the Taxability of Unemployment Compensation?

Pei Fang Guo, Petitioner v. Commissioner of Internal Revenue, Respondent 149 T.C. No. 14 Filed October 2, 2017 By Steven R. Diamond, CPA The United States has income tax treaties with many foreign countries. These treaties provide that residents of foreign countries may be taxed at a lower rate or may be exe... Steven R. Diamond, CPA

Taxation of Dividends From Foreign Corporations

U.S. persons frequently own legal entities abroad to pursue a variety of economic interests. Common U.S. ownership scenarios include expatriates forming foreign entities to locally operate businesses, U.S. residents forming foreign entities to capitalize on expansion opportunities, and entrepreneurial immigrants coming to the U.S. More often than not, these foreign entities default to corporate status à la the tax law’s default classification... Anthony (“Tony”) Malik, EA

Filing Requirements of Americans Abroad

Ownership of passive foreign investment company (PFIC) shares can easily be missed because their ownership is often hidden in security portfolio statements. A company is a PFIC by fulfilling one of two requirements; having at least 75 percent of its income be passive or having at least 50 percent of its assets be investments held for the production of passive income. Passive income includes, but is not limited to, interest, dividends, rents, ... Rainer Fiege-Kollmann, EA

May Tax Whistleblowers Always File Their Claims Anonymously So As to Be Protected from Retaliation?

Whistleblower 14377-16W, Petitioner v. Commissioner of Internal Revenue, Respondent 148 T.C. No. 25 Filed June 28, 2017 The IRS Whistleblower Office pays money to persons who blow the whistle on taxpayers w... Steven R. Diamond, CPA

Superchange Your Career in Tax: Become an EA

If you are considering a career in tax, there is no time like the present to obtain your enrolled agent (EA) license. EAs are America’s tax experts, and they are the only federally licensed tax preparers who also have unlimited rights to represent taxpayers before the IRS. Unlike some professional certifications, you can become an EA before you complete your degree, and there are many advantages in doing so. Start Now To become ...

2017 Tax Law Changes

So far this calendar year there has been very little action by Congress involving tax matters. Maybe I should say there has been no final action by Congress on tax matters. Lawmakers have discussed and introduced many small bills, but nothing that has reached joint committee. The one exception is the Disaster Tax Relief and Airport and Airway Extension Act of 2017, which is discussed in the cover article. The items that were last exte... David Mellem, EA

Can a Taxpayer Rely on Tax Preparation Software to Claim Deductions Recommended by the Software?

Barry Leonard Bulakites, Petitioner v. Commissioner of Internal Revenue, Respondent Many taxpayers prepare their own tax returns, without professional help, by using off-the-shelf retail software programs. These programs often offer recommendations based upon the information that is inputted by the taxpayer and may also provide one-toone answers... Steven R. Diamond, CPA

Preparing an Accurate FBAR: Ten Common Mistakes

The failure to file an accurate and complete Financial Crimes Enforcement Network (FinCEN) 114, (Report of Foreign Bank and Financial Accounts (FBAR)) can result in serious penalties and consequences for a taxpayer. Unfortunately, the FBAR is one of those deceptively simple forms that does not appear to be complex due to the limited number of entries required. However, those unfamiliar with the form are prone to mistakes, as detailed rules ex... Randall Brody, EA

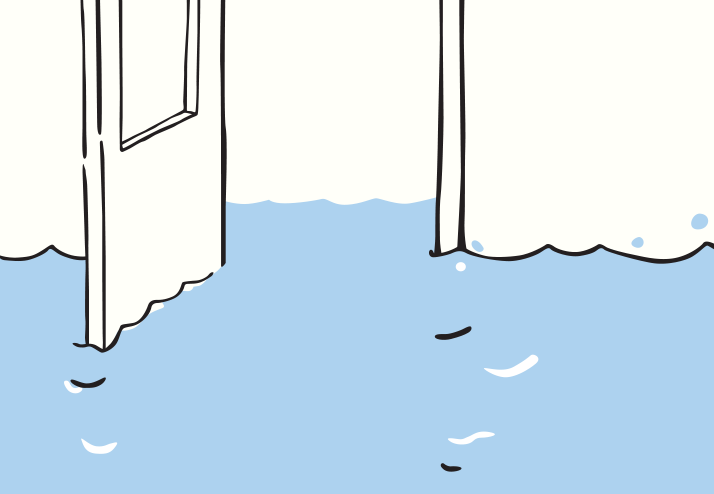

Section 165 Casualty & Losses

With the devastating impacts of Hurricanes Harvey, Irma, and Maria still fresh, we need no reminder that August through October is the peak of the Atlantic hurricane season (which occurs from June 1 to November 30). High winds, heavy rain, tornadoes, and subsequent flooding can all wreak havoc on coastal residents, including destroying billions in property every year for individuals and businesses alike. Taxpayers who live far from the oc... Stephen Mead

An Introduction to the Internal Revenue Manual

As a tax professional, what do you do when you encounter a client who has a problem or an issue which you have limited familiarity with or experience with? Do you prefer the client to another practitioner? Do you contact a colleague (or post a question in a forum) and hope that any advice that you receive will be sound? Or do you tell the client that you will do some additional research on the issue and get back to him? Your course of act... John G. (“Jack”) Wood, EA

Breaking Down the Tax Professionals Role in Estate Planning

Many of us look for additional income- generating avenues during the off-season. I became a certified estate planner to bring in extra money. You may be thinking, “What exactly is a tax professional’s role in estate planning?” Simply put, it is our job to watch for issues like the estate tax, while at the same time having a solid understanding of what will be done at the time of death and how to adhere to the estate plan. First of all, th... Craig W. Smalley, EA

Is an Interest in a Defined Benefit Plan Considered an Asset in Determining Insolvency?

David W. Schieber and Janet L. Schieber, Petitioners v. Commissioner of Internal Revenue, Respondent T.C. Memo. 2017-32 Filed February 9, 2017 Generally, a taxpayer realizes income equal to the portion of a debt that is owed when the debt is canceled or discharged. However, the income from the discharge of the debt may be excluded from income if, among other reasons, the discharge occurs when the taxpayer is insol... Steven R. Diamond, CPA

Tax Implications of Home Flipping: Dealer Or Investor

With today’s hot real estate market and rapidly escalating property values, many clients are engaging in real estate investing and house flipping. Indeed, there are many reality TV shows and real estate networks dedicated to glamorizing the quick profits that can be made in these activities. What these programs fail to mention are the tax consequences of these transactions. As tax professionals, that’s where we come in... Keith A. Espinoza, EA

Womb For Rent

Tom and Cindy Jones are your long-time clients. Tom has an auto body repair business with three employees and files a Schedule C. Cindy is a part-time dental hygienist, receiving W-2 wages. They have two children, ages 12 and eight. Their Schedule A deductions are pretty standard: home mortgage interest, charitable contributions, property taxes, and so forth. In May 2016, Tom calls you and asks for assistance on an IRS aud... Ruth A. Rowlette, EA

Adding Client Value, Divorce

The first in a series on using tax planning to guarantee satisfied clients and grow your business By Beth Logan, EA People think of tax season as running January through April. But most people make their biggest tax mistakes from May through December. There are two reasons for this. First, they aren’t thinking about taxes. Second, there are more days in which to err. This is my tax mantra. If you tell clients this, they ... Beth Logan, EA

Cyber Security For Tax Professionals

In the “Capitol Corner” column of the January/February 2017 EA Journal, Robert Kerr acknowledged that enrolled agents “did not become enrolled agents because of a deep and abiding passion for information technology, firewall construction, and/or secure remote access.” Kerr, however, added a warning to tax practitioners not to delude themselves: “The bad guys are out there, and they are after information that modestly sized practices h... Marshall J. Heap EA

Indirect Methods of Proving Income

Did you know the IRS requires its agents to perform a minimum income probe on every audit? And did you know that a minimum income probe can result in the IRS agent using indirect methods of proving income? If you have a client who is being audited—and even if you don’t—it is to your advantage to learn everything you can about indirect methods of proving income. Minimum income probes are discussed as part of the examination process governed... Jo-Ann Weiner, EA

When Is a Claim for Refund Timely Filed?

Yvonne A. Williams, Petitioner v. Commissioner of Internal Revenue, Respondent T.C. Memo. 2017-10 Filed January 10, 2017 IRC Sec. 6511 provides that a taxpayer may file a claim for refund within three years from the time the return was filed or within two years from the time the tax was paid, whichever is later. IRC Sec. 6402 provides that in the case of an overpayment, the com... Steven R. Diamond, CPA

Why Clients Hire Us to Represent Them

ONEDAY. I was meeting with a revenue agent (RA), representing a client during an audit. The office was set up with cubicles, and it was easy to hear what was going on in the cubicle next to me. I happened to hear a taxpayer who was representing herself while another RA was raking her over the coals. The RA who was helping me went off to make photocopies as I heard this lady begin to sob. I mean, the RA was really handing it to her. I got u... Craig W. Smalley, EA

Ethics Rules, Penalties, and the Tax Preparers Engagement Letter

Perhaps one of the most important, but also one of the most overlooked, parts of the 1040 U.S. Individual Income Tax Return is the section near the bottom of the second page that states: “Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct and accurately list all amounts and sources of income I received duri... Anthony Santullo, EA

Excess Depreciation Claimed, An Ethical Dilemma

I MET JUSTIN FUNDALINSKI of Jim Saulnier & Associates while volunteering time for the betterment of the Financial Planning Association. He asked a question that gave me pause. Tax questions that cause me to pause are the spice of life. His question was about a fascinating situation he encountered regarding depreciation and disposition of residential rental real estate. So down the rabbit hole I went, thoroughly reviewing t... John R. Dundon II, EA

Is the United States Tax Court a Court of Equity?

Grisel A. Smyth, Petitioner v. Commissioner of Internal Revenue, Respondent T.C. Memo. 2017-29 Filed February 7, 2017 Under the United States Constitution, the U.S. Tax Court is an Article I court. This means that the powers of the Tax Court are more restricted than those of courts that are granted pow... Steven R. Diamond, CPA

Reading the Internal Revenue Code

Why would anyone subject themselves to reading the Internal Revenue Code? It’s not exactly a spellbinding novel, or even an interesting nonfiction work on your favorite topic, unless your favorite topic is tax law. When most people think of the Code, they think of it as being an impenetrable morass of legalese gobbledygook, more useful as a cure for insomnia than a practical resource for the tax professional. But being able to effecti... Carolyn Richardson, EA

Gambling As a Profession Tax Implication

The thrill of a slot machine jackpot is exhilarating. Waiting for a casino attendant to come and do the legendary “hand pay” (paying the taxpayer at the machine) gets taxpayers’ hearts racing. Most taxpayers get so caught up in the moment that the tax consequence of their winning is a distant thought. It is so distant, in fact, that many taxpayers forget they even received that W2-G and leave it off their tax return. However, when the... Tracy L. Bunner, EA

Preparing For The New IRS Partnership Audit Rules

Partnerships and entities taxed as a partnership, such as certain limited liability companies (LLCs), have become a popular entity choice for doing business over the past 50 years. This tax structure offers business owners significant benefits, including taxation at only the partner level. Another benefit that often goes unnoticed is that very few partnerships are audited by the IRS. Moreover, when the IRS engages in a partnership audit, t... Travis Greaves, JD, Josh Wu, JD

Strategies for Avoiding CP2000 Notices

Let’s start at the beginning. What is a CP2000 Notice, and when is it generated? Here’s what happens. The IRS Automated Underreporter Unit (AUR) matches income reported on individual tax returns with the income that is reported to the IRS from various third parties (e.g., employers, financial institutions, and banks) and recorded in its wage and income transcript file. If there is a difference, the IRS “flags” the tax ... Bill Nemeth, EA

The Adoption Tax Credit and Foster Care Adoptions

Do you have clients who are foster parents? Do you have clients who have adopted from the foster care system? If you have answered yes to either of these questions, you need to know about the Adoption Tax Credit. Many taxpayers who are adoptive parents have been told they do not qualify for the Adoption Tax Credit because they had no expenses. As tax professionals, we often hear our clients say, “My friend told me something different.” Wi... Becky Wilmoth, EA

Using Your Website and Social Media to Gain Clients

Websites and social media are great ways to attract younger clientele to your business. In our digitally interconnected age, it is imperative to have a website that is more than an online business card. Here are five tips for an effective website: 1. A modern website must be mobile-friendly. In a world where there are more mobile devices than there are people on Earth, it is essential that your website be mobile-friendly. What e... Jennifer Brown, EA

When Can A Noncustodial Taxpayer Claim a Dependency Exemption?

William E. Lowe and Tess Lowe, Petitioners v. Commissioner of Internal Revenue, Respondent T.C. Memo. 2016-206 Filed September 26, 2016 RC Sec. 151(c) authorizes a taxpayer to deduct an exemption for each individual who is a dependent of the taxpayer for the taxable year. A dependent is defined as eith... Steven R. Diamond, CPA

Affordable Care Act For The 2017 Filing Season

This may be the final year for the Affordable Care Act (ACA). The incoming administration has vowed to repeal and replace Obamacare as quickly as possible. With that being said, the purpose of this article is to update you on the ACA changes affecting your clients for the 2017 tax filing season. The changes that began in 2013 are intensifying in 2017. So strap yourself in and get ready for the new changes. Since this article was written in De... Ben A. Tallman, EA, USTCP

Can an Estate Deduct a Theft Loss That Relates to Property Owned by an LLC in Which the Decedent Owned an Interest at the Time of His Death

Estate of James Heller, Deceased, Barbara H. Freitag, Harry H. Falk, and Steven P. Heller, Co-Executors, Petitioners v. Commissioner of Internal Revenue, Respondent 147 T.C. No. 11 Filed September 26, 2016 Internal Revenue Code Sec. 2054 provides that the value of a taxable estate shall be reduced by the value of gross estate losses incurred during the settlement of the estate ... Steven R. Diamond, CPA

Ride Share

Rideshares are a new phenomenon that replaces taxi services. These services use technology as the main apparatus for their business strategy. Customers can now request a ride through a smartphone application that will subsequently ping a driver nearby. Uber Technologies, Inc. started this idea in 2009, which led to numerous other startups. Rideshare services are more efficient than typical taxi cabs and are less expensive for the customer. Fu... Christine Kuglin, EA, Angela Busila, CPA, Brandon Anderson

Tax Implications of Owning Vacation Rental Property

One of the greatest feelings is being on vacation. At some point in our lives, we seek to travel to a special place to enjoy time away from work and the daily routines of life where we can relax and explore a place that we have dreamed about. Many people fall in love with their vacation destinations, and they want to come back to them on a regular basis. Some are fortunate and wise to purchase a place to live at one or several of these locati... Anthony Santullo, EA

2016 Tax Law Wrap-Up

Congress did finally take action on the “extenders” last December, but it has not done very much this year. Some of the extenders were made permanent, and some were extended for a set period of time, such as two years. The items extended for two years are again expiring on December 31, 2016, and have so far not been extended further, which means we are again faced with uncertainty on these items. Form 1099 As we ... David Mellem, EA

Can IRS Levy a Taxpayer If It Previously Mailed a Notice of Deficiency to an Address That Was Not the Taxpayer’s Last Known Address

IRC Sec. 6321 imposes a lien in favor of the United States on all property and rights to the property after the demand for taxes has been made and the taxpayer fails to pay the taxes. The IRS must first notify a taxpayer in writing of his or her right to a hearing on the issue of whether the lien is appropriate. A taxpayer may challenge the existence or amount of the underlying tax liability but only if a notice of deficiency was not ... Steven R. Diamond, CPA

Section 174 – Research and Development Credit Revised Regulation Analysis

In 1954, Congress enacted a temporary research and development (R&D) credit codi!ed by Internal Revenue Code (IRC) Sec. 174. "e purpose of the credit is to encourage inventors and companies to pursue research and development of new technologies. Although simple in theory, there have been problems with its implementation. Critics have argued that the credit is confusing as to which expenses qualify as “quali!ed research expenses.”1Darshan Wadhwa, CPA, and John Leavins, CPA

Tax Appointment Worksheet

The Tax Appointment Worksheet is a tool to help you gather the needed information for new and returning clients for the 2016 tax year. This year’s worksheet has been enhanced to reflect the changes in tax law. Now that the American Opportunity Credit is permanent, the need for the proper Form 1098-T and the educational expense evidence is increasingly crucial. Type of plan Amount of contribution Form 1099-... Mary Mellem, EA

Understanding the PFIC Rules and the Implications of Owning Foreign Mutual Funds

While many portions of the U.S. tax code possess confusing and sometimes harsh rulings, the tax rules for passive foreign investment companies (PFICs) are almost unmatched in their complexity and draconian features. Countless times, Americans overseas uncover a startling revelation that the small foreign investment they had made in a non-U.S. mutual fund is now subjecting them to all the significant filing requirements and tax obligat... Michael J. DeBlis III, Esq. and Randall Brody, EA

A World Of Alternative Fundraising A World Of Uncertainty

There are many ways our clients seek to get money for their businesses, inventions, or new endeavors. They apply for bank loans, ask family members, dip into personal savings, or in some circumstances, seek the help of venture capitalists. As with most things in life, each option has its plusses and minuses. But now there is a new kid on the block: crowdfunding. What is crowdfunding? According to Oxford Dictionaries.com, it is defined as ... Jeffrey A. Schneider, EA

Be Stubborn about Your Goals

I just finished my twenty-fifth filing season: ten at IRS, two on the Hill, and thirteen here at NAEA’s intergalactic headquarters, where I have been privileged to advocate for a great group of professionals. My accomplishment is a relative one, admittedly. I file one tax return a year— some say ill-advisedly (though often with the advice of my EA, whom I thank here anonymously)—and many of our members have significantly more filing s... Robert Kerr

Gearing Up For Tax Season Promote Your Practice and Your Credential

Autumn is the perfect time to begin promoting yourself and your EA credential in preparation for the upcoming tax season. Many members already know that NAEA provides tools to help them attract new clients and raise awareness of their EA credential, but many may not know that these tools are regularly refreshed. It’s time to take another look. Last year, NAEA formed a new partnership to present the improved “Find a Tax Expert... Gigi Jarvis, CAE

How to Maximize Penalty Relief For Your Clients

There are a number of ways delinquent taxpayers (your clients) can potentially reduce their overall debt to the IRS. There is the offer in compromise (OIC), that oft-dangled carrot and so-called “pennies on the dollar” settlement that many tax resolution firms pitch to lure negligent taxpayers to their companies. There is an innocent spouse resolution that can prevent one member of marriage from being liable for a tax debt caused by h... Jim Coleman, EA

If the Office of the Clerk of the Tax Court Is Inaccessible, How Is a Time Limitation for Filing a Petition Calculated

Felix Guralnik, Petitioner v. Commissioner of Internal Revenue, Respondent 146 T.C. No. 15 Filed June 2, 2016 The deadline for filing a petition in Tax Court is jurisdictional, which means that the time limit for filing a petition with the Tax Court has been fixed by Congress and, therefore, cannot be extended... Steven R. Diamond, CPA

The Uncanny Cannabis Controversy

I used to work in a Loew’s Theatre in California during the days of Flower Power, the draft, and the advent of the eighteen-year-old vote. Back then, movie theatres sold cigarettes and other tobacco products. After all, Loews owned the Lorillard Tobacco Company. At the time, word on the street was that Lorillard had trademarked several brand names for marijuana cigarettes, though you can’t find any evidence of that today. We were all very exc... Eva Rosenberg, EA

Can a Deceased Taxpayer Spouse Use the AMT Credit that Arose from ISO Exercised by the Spouse Before Death

Nadine L. Vichich, Petitioner v. Commissioner of Internal Revenue, Respondent 146 T.C. No.12 Filed April 21, 2016 Individuals do not recognize gain or loss when an incentive stock option (ISO) is granted or exercised for regular tax purposes. If the taxpayer's rights are freely transferable or not subject to a substantial risk of forfeiture, an adjustment must be made for alternative minimum tax (AMT) purposes by in... Steven R. Daimond , CPA

Criminal Tax Investigations Proceed with Caution

EACH YEAR, the NAEA National Conference delivers high-quality tax education to enrolled agents and other tax professionals. This year will be no exception! Once again, seekers of top-notch representation and tax preparation education will gather in Las Vegas, NV, at the Cosmopolitan Hotel August 1–3. To give you a sip of the action, we’ve chosen to showcase some of the outstanding education on tap this year. In the following... Theodore (Ted) A. Sinars, JD

Portrait of a non-filer

What is a non-filer? A non-filer is defined as a person (individual, corporation, estate, trust or partnership) who has met certain thresholds but has yet to file a tax return by the statutory or extended due date. As enrolled agents, we have to figure out how to help these people get compliant. Aft er all, besides making sure our clients do not pay more in taxes than they are required to, part of our job is to make sure that they are complia... Jeffrey A. Schneider, EA

What’s Your Process – How to Work a Collections Case

Introduction Coming into collection representation work in the late 90s, much of the disparity between practitioners rested in sorting out who knew the most rules and laws. A representative’s ability to answer questions relating to technical aspects of IRS enforcement (such as how many days exist before I lose levied money? or how long do I have to appeal a Trust Fund Recovery Penalty assessment?) were commonplace. Yet today with al... David Miles, EA

A Preparer Penalty Can Ruin Your Day

This issue of the EA Journal is all about ethics. Preparer penalties are often about a lack of ethics or a lack of due diligence. Here is one of the most comprehensive definitions of due diligence I have ever heard, given by my friend, fellow NAEA member, and NTPI Fellow, Conrad Mangapit, EA: Definition of Due Diligence – Part I A duty that paid tax professionals must perform to the best of their abilities in order... Kathy Morgan, EA

Outer Limits of Tax Preparation Practice

One of the primary reasons people become enrolled agents is to be able to help their clients with tax problems. EAs (as well as attorneys and CPAs) can represent taxpayers before all administrative levels of the IRS. In order to effectively represent taxpayers, however, EAs need to be aware of just how far a practitioner can go, both ethically and professionally, without exceeding the limits of authority granted by the EA designation. In the ... Thomas A. Gorczynski, EA, USTCP, Kevin C. Huston, EA, USTCP

What Constitutes a Valid Notice of Determination for Purposes of Starting the Thirty-day Period for Filing a Timely Tax Court Petition

Isaiah Bongam, Petitioner v. Commissioner of Internal Revenue, Respondent Petitioner 146 T.C. No. 4 Filed February 11, 2016 After a taxpayer has filed a Request for a Collection Due Process Hearing, the IRS will send the taxpayer a Notice of Determination detailing the outcom... Steven R. Daimond

Walking the Tight Rope

NINE STEPS TO MAKE YOUR MARKETING EFFORTS FROM RUNNING AFOUL OF CIRCULAR 230 Marketing your business is a critical skill to develop for bringing in customers and preventing violations of the tricky regulations surrounding how we represent ourselves before the public. Frequently, there are posts on social media groups about how best to market our businesses, yet few responses ever mention the legalities. Most areas of Circular 230 ha... Crystal Stranger, EA

Classification of Foreign Business Entities under U.S. Tax Law

An elementary question in business international taxation involves ascertaining the classification of foreign entities for U.S. tax purposes. This question emerges whenever a foreign business pursues U.S. economic activity or when a U.S. person establishes a business outside the U.S. While foreign entities enjoy definite classification under the laws of their respective countries of organization, their classification under U.S. tax law may be... Anthony (Tony) Malik, EA, MPAcc

How Can A Taxpayer Substantiate Expenses for Automobile Travel

David L. Charley and Julia A. Charley, Petitioners v. Commissioner of Internal Revenue, Respondent T.C. Memo. 2015-232 Filed December 2, 2015 A taxpayer may generally deduct from gross income the ordinary and necessary expenses of carrying on a trade or business that are paid... Steven R. Diamond, CPA

Speaking the Same Language

Matt Groening, creator of The Simpsons, once lamented, “I know all those words, but that sentence makes no sense to me.” As an enrolled agent, you may mutter something similar to yourself as you scan through the latest IRC update for the umpteenth time. Then, once you master the tax jargon, you must translate it into layman’s terms and communicate with your clients. Challenging as this may be in English, some NAEA members go another step furt... Julia Shenkar

Streamlined Compliance Procedures for Non-disclosed Foreign Bank Accounts

With the global business environment changing, the world does not seem as vast. Advances in technology have increased awareness of different parts of the world and have made communication cheaper and more efficient. The U.S. citizen is now more mobile than ever before. Additionally, immigrants who may have thought the U.S. was an ultimate destination have begun to move back to their home countries because of equally attractive incomes and lif...

2015 and 2016 Key Numbers

Single TAX RATES 2015 2016 10% bracket tops at 9,225 9,275 15% bracket tops atDavid Mellem, EA

2016 Healthcare Updates

The following is designed to review healthcare changes impacting your clients for the 2016 filing season. The changes that began in 2013 and 2014 are intensifying in 2015. So, strap yourself in and get ready for the latest changes and information that is coming. Since this article was written in the fall of 2015, review of more recent updates is recommended. New Healthcare Coverage Forms for Tax Year 2015 You’ve se... Ben A. Tallman, EA

The Grand Parent Tax

GST is imposed on a direct transfer of property to a grandchild that would otherwise be subject to two levels of estate taxation if first taxed as part of the parent’s estate. It is then transferred from parent to child, taxed as part of the child’s estate, and finally transferred to the grandchild. To ensure that such transfers do not entirely escape two levels of taxation, assets conveyed are subject to GST at the time they are tran... Monica Haven, EA, JD, LLM

The IRM: A Resource for the EA

It may not make the New York Times best seller list (and it certainly would not be light reading while waiting for a plane at the airport) but the Internal Revenue Manual (IRM) can be an extremely useful document for enrolled agents in their dealings with the Internal Revenue Service. The Freedom of Information Act at 5 USC 552(a)(2)(c) requires agencies to make staff instructions available to the public. Frank X. Degen, EA, USTCP

Up in the Air with IRD

25 January• February 2016 B January• February 2016 26 In short, IRD is income that had been earned by a taxpayer prior to his death but that had not yet been paid to him. 27 January• February 2016 January• February 2016 28 29 January• February 2016 January• February 2016 30 SOURCE OF INCOME NOTES REGARDING IRD TREATMENT ACCOUNTS RECEIVABLE Uncollected sales proceeds from pre-death sales of c... Monica Haven, EA, JD, LLM