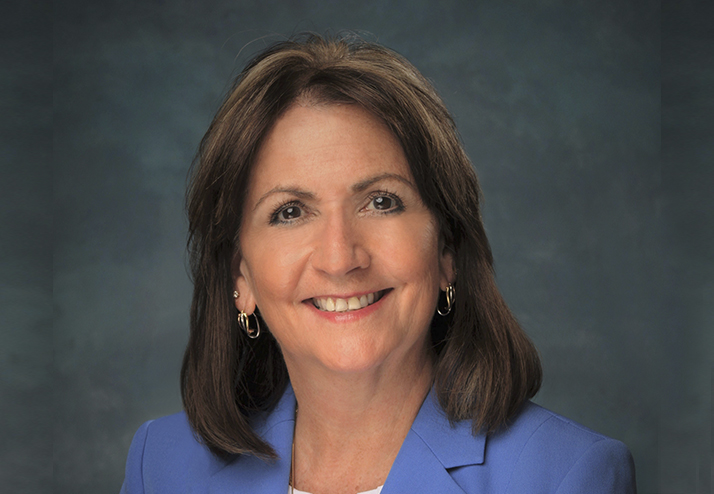

Chelsea Rustek, EA

Where do you reside? Crystal River, Florida What got you involved in the tax profession? I’ll be honest, the profession found me. I went to college with no degree or job in mind, per se, but my brother urged me to bec... Chelsea Rustek, EA

Are Enrolled Agents Finally Having a Moment?

I am going off this issue’s EA Journal topic because I can’t wait to tell you what I am seeing and hearing. The secret is out about enrolled agents (EAs). The decades-long struggle to get some respect and awareness in the marketplace is making some headway. Enrolled agen... Megan Killian

Bigger and Better Together

I hope this letter finds everyone in high spirits at the National Association of Enrolled Agents (NAEA). I know I am! A lot of change has taken place this past year, so it is with great honor and enthusiasm that I address you as your new president. First and foremost... Twila Midwood, EA

Ethical Dilemmas

In the ever-evolving landscape of tax law and practice, staying abreast of ethical standards is not just a professional obligation but a cornerstone of maintaining integrity and trust within our industry. Welcome to the Ethics issue, where we delve into the intricate rea... Tynisa (Ty) Gaines, EA (She/Her)

Disagreeing Digitally: Ten Tips for Keeping the Peace Online

As we power through tax season, a lot of us are spending more time online, whether to discuss tax matters with colleagues or just distracting ourselves from our work. With increased stress and an ever-changing tax cod... Josh Youngblood, EA

Worldwide Tax Matters

I am intrigued by the intricate concept of worldwide income and its pivotal role in international taxation. The principle of taxing citizens on their global earnings underscores the belief that individuals should contribute to their home country's financial landscape, ir... Tynisa (Ty) Gaines, EA (She/Her)

Jake Johnstun, EA, NTPI Fellow®

Where do you reside? Ogden, Utah What got you involved in the tax profession? I am a third-generation accountant and second-generation enrolled agent. What is your day job? I run my pr...

The “EA” as an International Credential?

The number of enrolled agents (EAs) in India has grown from 673 in 2017 to 2,262 in 2023. Enrolled agents in India now make up 3.1 percent of all enrolled agents. What’s driving this growth and how does it impact the EA profession, EA firms and employers, and the professional organi... Megan Killian

New Year, New Changes Coming to the National Association of Enrolled Agents

In this new year, I want to express our heartfelt gratitude to all those who took the time to vote in December and make their voices heard. Your participation in the decision-making process has been instrumental in shaping the future of our organization. By casting your votes, y... Cynthia Leachmoore, EA

Practice Management for Part-time Enrolled Agents

If you are an enrolled agent (EA) that prepares taxes on a parttime basis, practice management becomes a critical component of your success year after year. Automation and operationalization of your tax work will be key ... Dannie Lynn Fountain, EA

Leadership: What Is in It for Me?

As members of a professional association, the time and talent that we dedicate to the organization helps benefit the community as a whole. However, what we receive in return can go beyond the satisfaction of a job ... NAEA Leadership Development Committee

Non-practice Ownership Enrolled Agent Career Paths

Introduction The reality of our modern corporate world is that moonlighting is growing at a rate three times faster than the traditional workforce with no signs of slowing down.i Moonli... Dannie Lynn Fountain, EA

Preparing for the Upcoming Tax Season: Key Updates and Tools for Tax Professionals

As we approach the upcoming tax season, tax professionals and taxpayers alike are gearing up to navigate the ever-changing landscape of tax laws and regulations. To help you stay on top of the latest developments and prepare for a successful tax season, this issue brings... Tynisa (Ty) Gaines, EA (She/Her)

The Year of Possibilities

As one year closes out and a new one begins, a common tradition is to make resolutions. I don’t like resolutions. Maybe it is because they tend to frame some perceived negative behavior, such as “I will stop procrastinating,” “I will get off the couch and go the gym,” or “I will... Cynthia Leachmoore, EA

Roslyn Haynie Banks, EA

Where do you reside? Williamsburg, Virginia What got you involved in the tax profession? Working on my family farm in the Northern Neck of Virginia as a child. I took an accounting course in high school, went to c... Roslyn Haynie Banks, EA

Tax Appointment Worksheet

The tax appointment worksheet is a tool to help you gather the needed information for new and returning clients for the 2023 tax year. This year’s worksheet has been enhanced to reflect the changes in tax law. The energy credits will be... Compiled by Mary Mellem, EA

What Does Inclusion Mean?

Once upon a time, there was a young naïve woman who was working for a large organization based in a big city. Having been raised in the suburbs in a relatively homogeneous community, she was not very knowledgeable about diversity. It was the early aughts, so it wasn’t really somethi... Megan Killian

Shonna Bedford, EA

Where do you reside? I live in Pasco County, Florida. What got you involved in the tax profession? My father had been an enrolled agent and tax attorney. He passed away last year. My whole life was surrounded by tax season...

Evolving to Serve

In this issue, I want to talk about the state of the National Association of Enrolled Agents (NAEA) through the lens of why we exist; how the things that define us at a core level serve us now; and how they must evolve to serve us in the future. As I have said before, my guid... Cynthia Leechmore, EA

Advocacy and Representation Within Our Association

Each National Association of Enrolled Agents (NAEA) member has a unique perspective and a distinctive voice. This diversity is what makes our association stronger and more powerful. We strive to build and support an organization that truly represents the enro... Megan Killian

NAEA Fly-In Day at the Capitol

I always love to advocate, especially for worthy causes. Joining this organization, the National Association of Enrolled Agents (NAEA), and having the Political Action Committee (PAC) to advocate on behalf of taxpayers is what I needed when looking for an organization. Attending the NAEA Fly-In Day at Capitol Hill exceeded my expectations. I never thought that I would be able to meet our lawmakers in both the lower and upper chambers. Atte... Nancy Remo, EA

Representation Matters

During the 1700s, American colonies under British rule coined the phrase "taxation without representation." This opposition to being taxed without having a say in government was a major factor in the American Revolution. Today, there are still areas such as the District ... Tynisa (Ty) Gaines, EA (She/Her)

Ethical Concerns in Using Tax Planning Software

What Are My Ethical Responsibilities When I Use Software to Produce a Tax Plan? In the world of taxes, there are many ethical issues that can come into play. One area that involves judgment and expertise is when it come... Dominique Molina

You Reap What You Sow

As the new editor-in-chief of the EA Journal, I wanted to introduce myself. I didn’t initially plan on working in tax. In fact, I dropped my accounting courses in college and graduated with a Bachelor of Arts degree in Industrial Psychology and a Master of Scien... Tynisa (Ty) Gaines, EA (She/Her)

Big Changes Require Strong Ethics

“ Change your opinions, keep to your principles; change your leaves, keep intact your roots.” – Victor Hugo The National Association of Enrolled Agents (NAEA) Code of Ethics clarifies roles and responsibilities within a profession and provides g...

Connect. Unite. Empower. Serve.

Thank you for this honor of serving as your president for this coming year. I am joined by a group of talented Board and Committee leaders and our amazing staff, who are excited to serve our enrolled agent (EA) community. We have emerged from several years of Covid restrictio...

NAEA Ethics and Professional Conduct Committee – How Can We Help You?

We wish we were writing this article more from a theoretical perspective than a practical one (i.e., few or no complaints about National Association of Enrolled Agents (NAEA) members). Sadly, over the past year, we have seen a m... The National Association of Enrolled Agents (NAEA) Ethics and Professional Conduct Committee

Your Ethics Footprint

A footprint leaves an impression. You can visualize your footprint on a sandy beach or the snow. At times, your footprint is not easy to see. Sometimes, you do not even realize you left your footprint as you do your walking in life. Over the years, we have h... Ruth Ann Michnay, EA, CPA, USTCP

Pat Dimmitt

Where do you reside? Indianapolis, Indiana What got you involved in the tax profession? A bad economy! My undergraduate degree was in finance, and I had hoped to work in banking. My first job after graduation was...

What a Ride!

I never would have dreamed when I arrived in Washington, DC, in 2008 to attend the National Association of Enrolled Agents (NAEA) Fly-In Day, that I would someday be the NAEA’s president. It was my first NAEA event. The first of many NAEA experiences that I look back on... Kathy Brown, EA

Come for the CE, Stay for the Community

I recently put out an SOS for assistance from our members. It was the beginning of tax season, and I knew it was a big ask. But I was in a bind, and it was something that only a tax expert could help with. Several members came to my aid, and they did it quickly and without complaint... Megan Killian

Like Father, Like Son

My first tax season was in 2000 (the 1999 filing season). Three tax seasons later in September 2002 at 24 years old I became an enrolled agent. My father has been an enrolled agent for more than 40 years, so that is what started my intere... Brien G. Gregan, EA

If Anyone Is Familiar with Change, It Is NAEA Members

I am so very pleased to assume the position of editor-in-chief of the EA Journal. The EA Journal is an award-winning publication that provides expertise and insight on tax topics. It is an important part of National Association of Enrolled Agents’ (NAEA... Tynisa (Ty) Gaines, EA (She/Her)

The Passing of the (Winter) Guard

I have coached a competition winter guard team for our local school system for over 11 years. I got involved after attending a competition to watch a close friend’s daughter perform for a different high school winter guard team. While there, for the first ... Kathy Brown, EA

Bigger Bases and Pitch Timers

I recently listened to an interview with the Phillies announcer about the changes to Major League Baseball (MLB) that will be implemented next season. I should note that I am not really a baseball enthusiast (unless the Phillies are in the World Series!), but this conversat... Megan Killian

Looking Forward to 2023

I am excited about 2023 – are you? There is much opportunity in our profession if you ask me. Demand for our services is high, and the supply of qualified tax professionals is decreasing. This gives us the opportunity to be selective about selec... Thomas Gorczynski, EA, USTCP

Are You Prepared for Next Tax Season?

Many of you use October, November, and December to make changes in your business for the upcoming year. As you make those decisions, I strongly urge you to consider the following: Advisory Services. Many clients do not see value in a completed tax return; ... Thomas Gorczynski, EA, USTCP

It Is Election Season and Your Vote Counts

By the time you read this, the midterm elections will likely already be over. Whatever the outcome, the next Congress will have a critical impact on tax administration and the enrolled agent (EA) profession. As new legislators take office in early 2023, one of the first thi... Megan Killian

Alone, We Can Do So Little

As this issue of the EA Journal finds its way to you, I hope it finds you surrounded by family, friends, and enjoying the fruits of a successful tax season. As I reflect on the 2022 tax season, I must admit that I have found enjoying this career t... Kathy Brown, EA

If at First You Do Not Succeed…

I had been a California registered tax preparer (CRTP) for seven years and I had just passed the Registered Tax Return Preparer (RTRP) exam. Then the law was repealed and the RTRP designation became worthless. This spurred me... Niki J. Young, EA

Advocacy in a Challenging and Unpredictable Post-COVID Atmosphere

As we all know too well, enrolled agents (EAs) are regularly impacted by laws, regulations, and policies passed in the United States Congress, state capitols, and local governments across the country. Whether it is new tax... Thad Inge and Michelle McCaughey

Embracing Change

I recently decided it was time to update my headshot. After all, the other one was more than five years old. As I looked at my new picture, I noticed how much my face had changed. Where did that face of five years ago disappear to? Comparing my old and new headshots was... Kathy Brown, EA

Consider Twice, Act Once!

Every member of the National Association of Enrolled Agents (NAEA) is charged with upholding our Code of Ethics and Rules of Professional Conduct in addition to complying with the ru... Elizabeth Ann “Betsey” Buckingham, EA

Why I Became an Enrolled Agent

I started my career in the restaurant business. I worked my way through college to earn a business degree. During those years I worked in a hospital kitchen that also offered a culinary school. I took the culinary classes, we... Carlos C. Lopez, EA

Collaboration and Partnership Creates Success for All

No organization is completely self-sustaining. Businesses of all sizes and scope rely on services and support from other entities. Even sole practitioners need to engage with others to perform their services. The power of relationships fuels associations like the National Associa...

A Blueprint for the Future

On a recent hiking trip, I came across a tree reaching at least 40 feet into the sky and growing on top of a rock that stood at least three times taller than me. As I stood in awe, I noticed the tree’s roots. While the majestic tree grew strong on top of this... Kathy Brown, EA

Sharing a Common Purpose

I was the first in my family to go to college and I had no idea what to study. I was good at math and science. At one point, I dreamed of building roads and bridges in remote places and considered engineering. Fortunately... David Tolleth, EA

The Fight Continues Today and Every Day

The success in Minnesota was a big win for enrolled agents (EAs). For two years, the National Association of Enrolled Agents (NAEA) worked with various state agencies, lobbyists, attorneys, and other stakeholders to reverse a mistake that would have been detrimental to the ...

The Time to Make Business Shifts Is Now

Before you know it, it will be time to wrap up extension returns. Then once those are out the door, you will start gearing up for the next tax season. I believe November is too late to consider significant shifts for the upcoming tax season. It would help if you beg... Thomas Gorczynski, EA, USTCP

Insurance Claims that Can Ruin Your Tax Preparation Business

Tax preparers and enrolled agents have significant legal exposures. Consider some of the potential claims you might face and how professional liability insurance can help you mitigate them. “Nothing ... Lauren Pitonyak

Deciphering a Law: An Introductory Learning Module

Tax laws are often hard to comprehend, making it an unwelcome task. Even seasoned practitioners find themselves pouring over well-settled areas of the tax code. It can be a demanding a... Thomas J. Williams, EA, and Iris K. Palma, JD

Our Job Is to Ask and Listen

It is an honor to be serving as the president for the National Association of Enrolled Agents (NAEA) this year. I have been involved with the NAEA in many ways over the years, having served on various committees and the board of directors. I have watched the ... Kathy Brown, EA

Cyber Insurance — Do You Have Adequate Limits?

Many insurance companies now offer cyber insurance as a part of their business package policies with available limits ranging between $25,000 to $50,000. Typically considered add-on coverage, this protection appears t... Robert G. Moody and George J. Kolczun, Jr.

Providing a Positive Difference

About 12 years ago I landed what I thought was the perfect job for me at a company I had long admired. You might be wondering, “What was the job and for which company?” Here is on... Jonathan B. Call, EA

Taxes and Disco at the Summer Event

The national conference was one of the National Association of Enrolled Agents’ (NAEA) signature events for years. Drawing, at its height, close to 800 attendees, it was the event for education, networking, and (even) a little bit of fun. In 2022, we are bringing back al... Megan Killian

Using Technology to Build Relationships

No one gets into business wanting to do sales. However, as a firm owner, you quickly realize it is a part of the job. With no customers, there would be no revenue, so you search high and low to find tho... Nayo Carter-Gray, EA

The Key to Success

Like so many colleagues, my enrolled agent (EA) journey began through a series of random forks in the road and some fortunate stumbles into opportunities. Career by happenstance, I suppose, but I also hear my father’s words of advice rattling aro... Jennifer MacMillan, EA

Health and Wellness During Busy Season

It may not seem like a priority when you have deadlines, client demands, family obligations, and other priorities right now, but consider adding self-care to your priority list. If the last two years has any silver linings, it is the increasing awareness of mental and ph... Megan Killian

“We’ve Always Done It This Way” Is Not the Future of the NAEA

You cannot say we were not warned. Both Treasury and the Internal Revenue Service (IRS) said this filing season would once again be rocky. For once they did not disappoint. My friends and colleagues in my state affiliate are emailing, calling, and meeting together r... David Tolleth, EA

Lessons from Another Difficult Tax Season

We are amid our third difficult tax season in a row: 2020 gave us the Families First Coronavirus Response Act and the CARES Act; 2021 gave us the Consolidated Appropriation Act, 2021, and the American Rescue Plan Act; and 2022 continues the aftermath of all these tax laws... Thomas Gorczynski, EA, USTCP

Earning Recognition

Right out of college, I was offered my first job in the insurance industry as a claims adjuster. About three years into my role, a position opened in the Accounting Department at the company. With the recommendation of my boss, I applied. Since I h... Nicole Green, EA, NTPI Fellow®

A Social Media Primer for Busy Enrolled Agents

Not on social media? Feel like you are too old or not techy enough? Have an established practice and do not think it is necessary to engage with your community or outside your immediate circle? Even experienced enrolled agen... Amber Gray-Fenner, EA

Every Taxpayer Deserves Tax Planning

As I write this column, it appears major tax changes are on the horizon as Congress debates a reconciliation bill that has the potential of significantly raising taxes on households making $400,000 while providing many additional tax benefits to those who make less than t... Thomas Gorczynski, EA, USTCP

Cyber Insurance: What Am I Getting for My Money?

Along with everything else, the cost of insurance continues to rise. Because of the surge in cyber hacking claims, insurance companies have no choice but to raise their premiums. CFC, the underwriting company for the National Association of E... Robert G. Moody and George J. Kolczun, Jr.

Being the “Bestest” Tax Nerd You Can Be

I became enamored with taxes at a very early age. I will forever be thankful to my math teacher in junior high school who introduced me to taxes. For two weeks, a long table was strewn with piles of tax forms. I can still remember the wonderful smell of m... Robin Gervais, EA

Winning at the Tax Planning Game

Tax planning is like playing a game with the Internal Revenue Service (IRS)—they hand us a rule book, we have to follow their rules, and if your client overpays in taxes, you lose. If you can play by the rules and find savings for your clients... Duke Alexander Moore, EA

Setting the Path

Like many organizations, the pandemic has forced the National Association of Enrolled Agents (NAEA) to reassess, reprioritize, and reimagine. Business as usual has been disrupted on all levels: from the way we collaborate and communicate as a team internally to how we engag... Megan Killian

The Role Technology Plays in Your Practice

Wikipedia has defined technology as "the sum of any techniques, skills, methods, and processes used in the production of goods or services or in the accomplishment of objectives, such as scientific investigation.” As a n... Nayo Carter-Gray, EA

Flying the EA Flag

My enrolled agent (EA) journey is probably different from many others. My journey began in 1991, about 15 years into my 22-year United States Air Force career. My squadron commander asked me to take on an additional duty as the unit’s tax advisor. And by “additional ... Brian D. Prucey, EA

NAEA Members Win Big in Vegas

More than 150 National Association of Enrolled Agents (NAEA) members and guests braved the Las Vegas heat in July to attend the Special Topics Workshop, our first live event in 19 months. Some came for the content, some came for the location, but almost everyone came for th... Megan Killian

Why Your Marketing Message Needs to Be Updated This Year

When was the last time you updated your marketing message? You may not know how or what to craft into a compelling message. You are a tax professional not a marketer. But you are also a business owner running a business… i... Janel Sykora

From Expat to Entrepreneur to EA

I did not know it at the time, but my enrolled agent (EA) journey began in 2002 when my wife, Carrie, and I moved from the United States to Barcelona to pursue our Master of Business Administration (MBA) degrees. When we graduated in 2004, we... David McKeegan, EA

Do No Harm

As someone who has been in the tax game for over 40 years and exclusively in the world of international tax for the last 18 years, my company has flourished and prospered on the mistakes of others. In 2013, when I... Mary Beth Lougen, EA, USTCP

What Is Tax Technology?

There is a sea change happening in the tax industry: Where the focus was once on compliance, it is now about value—ensuring fair taxes are being paid, managing tax risk, evaluating the tax consequences of business activities, and more. Underlying this shift to a more... Brandon Van Volkenburgh

The Elephant in the Room: Human Errors and Tax Notices

Humans make mistakes – it is a fact. And it is also the one thing that all tax preparers have in common. Transposition errors, excluding important numbers, forgetting to check a box, or duplicating an entry – all of these mistakes are prevalent in the ind... Patrick (Pat) Roberts, CPA

From Hero to Zero in 60 Seconds or Less

The following is a collection of anecdotes from members of the National Association of Enrolled Agents' (NAEA Ethics and Professional Conduct (EP&C) Committee. Names have been changed to preserve the confidentiality of our complainants and respondents. So...

What Is Next?

There is light at the end of the tunnel. But the pandemic will certainly leave its mark and change how we do things in the future. The slow return to some normalcy is coming, and in some cases, is already here. Hopefully, all of you have seen friends and loved ones you have... Megan Killian

Ethics in Publishing: Cite Your Sources

“… citation, the actual process of choosing which papers to cite when writing papers, has largely escaped scrutiny. Like it or not, citations are the currency of success in science.”i Discover magazine noted th... Christine Kuglin, EA

Create Raving Fans

A tax preparer’s goal should always be to provide excellent service to every client. But going the extra mile will help you create raving fans. A “raving fan,” as developed by Ken Blanchard, is a client who has that “knock your socks off” kind of... Terry M. Judge

Due Diligence: How Do You Do It and How Much Is Enough?

When I was director of the Office of Professional Responsibility, one of the most frequent questions I received from tax professionals around the country was: "How do I know when I have done enough due diligence?" The ultimate answer: “It depends,” sho... Karen L. Hawkins

A Turning Point

I got into the tax business as a means to an end—a way to make decent money without working all year, frankly. My dad and uncle owned and operated a multilocation tax preparation business in the Los Angeles area: Pronto... Andrew Freiburghouse, EA

A Primer on Significant Sections of Circular 230 for the New Practitioner

Circular 230 imposes certain duties and restrictions upon all practitioners.i It also delineates 18 nonexclusive acts of incompetence and disreputable conduct for which a practitioner may be disciplined. If ... Karen L. Hawkins

Can You Work 15-Hour Days and Be Ethical?

Enrolled agents, and the tax community as a whole, work too much during tax season, and it puts taxpayers at a disadvantage. I know you may not want to hear this because it is contrary to your business model of jamming eight to 15 tax returns per day into your schedule, six to ...

The Future of NAEA

This being my first column as president of the National Association of Enrolled Agents (NAEA), I want to thank you for entrusting me with this role." A little bit about how I ended up here: I am a transplant from Southern California to New Jersey. My first career wa... David Tolleth, EA

Three Untapped Niches of Opportunity for Your Firm in 2021

Dentistry. Construction. Real estate. Working with clients in these industry verticals can provide your firm with incremental growth. While these niches are certainly solid areas to explore as you look toward increasing your firm’s profitab... Gaynor Meilke

The Will to Succeed

As a child, I was a refugee, a destitute immigrant, and a member of a family of Holocaust survivors. English was not my first language; perhaps my third, by the time I was 5 years old. I also had a speech impediment and spent years in speec... Eva Rosenberg, EA

Honing Your Entrepreneurial Spirit

The age old axiom, “The only constant in life is change,” is abundantly true. I have had an opportunity to analyze how much NAEA has changed since the spring of 2015 when I moved to another organization. I barely recognize any of the staff. The Board is comprised of many new faces. T... Michael Nelson

The Key Differences Between Media, Analyst, and Influencer Relations

Raising awareness around your firm and its offerings should mean more than throwing spaghetti at the wall and seeing if it sticks. A strategic public relations (PR) and marketing plan will get you closer to your goal, whether that is recognition... Tanya Amyote

Navigating Tax Groups on Social Media: When Did Tax Become a Contact Sport?

It has been a rough year and I have seen it all. People who feel beaten up for asking questions and people doing the beating up. People arguing when they do not get the answer they want to hear from other people who are recognized experts on that particular topic. People argui... Amber Gray-Fenner, EA, USTCP

What in the World Is Design Thinking for a Tax Firm?

I am sure all of you have heard the term “design thinking” – and probably tossed it aside since design thinking could not possibly relate to tax firms, but you would be wrong. Allow me to start at the beginning by defining design thinking, and then offe... Brandy Jordan